China’s Digital Currency and What This Could Mean For Foreign Companies and Financial Institutions in China

Banking & Finance Alert

February.09.2021

China is operating increasingly on a cashless basis. In 2020, cashless transactions amounted to US$49 trillion, accounting for every four out of five payment transactions. The Chinese government has now taken a large leap in financial technology and is poised to launch its digital currency called Digital Currency Electronic Payment (DCEP or “digital yuan”). While the concept of a central bank digital currency (CBDC) is not new and many governments around the world are already exploring CBDC and its potential[1], China’s development and soft launch of DCEP is at a global forefront. When DCEP will officially launch in China, there is little doubt that the population can easily adapt to its use. More importantly, the launch of DCEP can have significant ramifications on a global scale, as it could reduce China’s reliance on the SWIFT system for international banking and offers the first glimpse of the internationalization of the renminbi (RMB).

Interestingly, on January 16, 2021, SWIFT established a joint venture in Beijing with China’s central bank’s, the People’s Bank of China (PBoC), clearing center and its digital currency research institute. The other shareholders of the joint venture are China’s Cross-border Interbank Payment System (CIPS) and the Payment and Clearing Association of China, both supervised by the PBoC. Many believe this is another signal that China is actively exploring the internationalization of DCEP.

In this article we answer key questions that you may want to know about the digital yuan.

1. What is China’s digital currency?

China’s digital currency is called Digital Currency Electronic Payment (DCEP)—it is also commonly referred to in China as “e-CNY” or “Digital RMB.” It is the digital form of China’s fiat money. It has been issued in small scale by the PBoC in pilot programs but has not yet been formally launched. DCEP is designed as a replacement of the reserve money system and pegged to the RMB in a 1:1 ratio.

2. What are the laws regulating China’s digital currency?

There is currently no existing law regulating DCEP, although the expectation is that China will formulate standards and guidelines for DCEP soon. As early as 2016, the then governor of PBoC announced plans for China to issue a digital RMB. In that same interview, however, he also acknowledged that there was no clear timeline and for a big country like China, it could take 10 years to develop a digital RMB. That same year, PBoC formed a digital currency research center. Fast forward to 2020—in July 2020, the term “digital currency” first appeared in official documents in China.

Specifically, on July 22, 2020, “digital currency” was cited in an opinion issued by China’s Supreme People’s Court and the National Development and Reform Commission (Opinion on Providing Judicial Services and Protection for Accelerating the Improvement of the Socialist Market Economic System in the New Era). The opinion states that China will “strengthen the protection of new rights and interests such as digital currency, online virtual assets, and data.” This opinion begins to afford “digital currency” with some legal protection.

In addition, on October 23, 2020, China’s PBoC released the revised draft Law of the People’s Bank of China for solicitation of public comments (“Draft PBoC Law”). The Draft PBoC Law stipulates that RMB includes both physical and digital forms, which provides the legal basis for the issuance of DCEP. Moreover, this draft law reiterates that, other than DCEP, there is a wide prohibition on producing and selling of digital tokens in replacement of RMB. The period for accepting public comments ended on November 23, 2020. It is expected that the draft law may become law sometime in 2021.

As China formulates more laws, regulations, standards, and/or guidelines on digital currency and the circulation and use of DCEP, we will continue to provide updates.

3. Advantages of a digital currency

Compared with traditional payment methods, it is expected that China’s DCEP will have the following features and advantages:

- Digital currency has a higher level of security against counterfeits;

- DCEP differs from the traditional way of e-payment where a transaction must utilize a third-party intermediary; while with DCEP, one may conduct transactions even without the internet or bank account utilizing near-field communication (NFC) technology. While DCEP will first be launched in China’s developed regions, NFC technology could also provide those in remote rural areas without steady internet access or bank accounts with easy access to DCEP;

- DCEP utilizes “controllable anonymity,” which means, when trading with DCEP, both parties can be anonymous to the public, but the PBoC could still track all trading information in China’s efforts to combat corruption, money laundering, tax evasion, and terrorist financing;

- DCEP could facilitate the internationalization of the RMB, and moreover reduce China’s reliance on the SWIFT system;

- As a first mover for a major economy, DCEP could set a global standard for digital central bank currencies.

4. What are the key differences between China’s digital currency and other payment methods?

We compare the key features of DCEP with other popular digital currencies and payment methods as follows.

|

|

DCEP |

CASH |

LIBRA/DIEM |

BITCOIN |

Electronic Payment |

|

|

Digital fiat money |

Physical fiat money |

Private digital currency |

Private digital currency |

Bank claim |

|

Credit Backed by |

PBoC |

PBoC |

Libra Association |

n/a |

Commercial banks / payment institutions |

|

Underlying Technology |

Integrated infrastructure which does not necessarily rely on fixed technical path |

n/a |

Consortium chain |

Blockchain |

Centralized e-payment platform |

|

Offline Payment |

Yes |

Yes |

No |

Yes (Lightning Network) |

No |

|

Cross-border Payment |

Yes |

No |

Yes |

Yes |

Yes |

|

Clearing System |

Central Bank |

Central Bank |

Libra Association |

Consensus mechanism |

Commercial Bank |

|

Transaction Limit |

Depends on the level of the DCEP wallet |

n/a |

n/a |

No limit |

Depends on limit set by commercial banks |

|

Privacy |

Controllable anonymity |

Complete anonymity |

Partial anonymity |

Complete anonymity |

Traceable |

|

Risk Identification |

Big data |

n/a |

KYC |

n/a |

Big data |

5. How does China’s digital currency work?

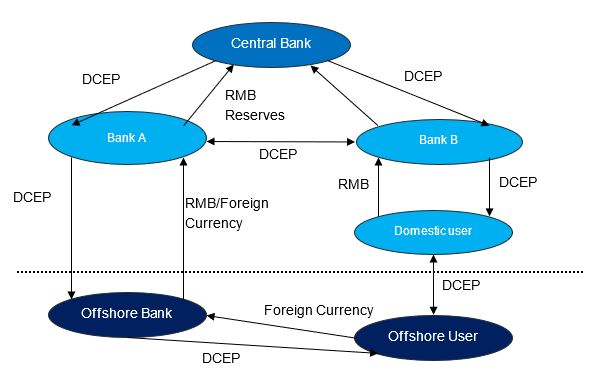

Official details on how DCEP operates are scarce. The PBoC has not released any white paper on DCEP’s technical details, nor would we expect any operational details to be released any time soon. What is clear is that the issuance and distribution of DCEP will be based on a two-tiered system.

- The first tier would be issuance of DCEP from PBoC to commercial banks and nonfinancial institutions such as Alibaba, Tencent, and UnionPay (i.e., intermediaries).

- The second tier would be distribution of DCEP from the above-mentioned intermediaries to end users such as companies and individuals.

- The end users could then make payments using DCEP wallets (via QR code payment, NFC, etc.).

The PBoC would create the actual digital RMB, but the end users would acquire the currency through software wallets provided by the financial intermediaries. The DCEP wallets would reside in Internet of Things devices and allow for payments off-line; transactions can be facilitated even when there is no internet connection at the time, and the parties could transact simply by tapping each other’s phones. This means that users can spend DCEP in no signal areas, such as in remote rural areas or on airplanes.

6. Status of the DCEP pilot programs

In April 2020, China started a controlled soft-launch of DCEP in various cities in China: Shenzhen, Suzhou, Xiong’an, and Chengdu. Participants in the pilot programs reported that using DCEP via a QR code is similar to that of WeChat Pay and Alipay, but it does not necessarily rely on the internet and does not need to be tied to a bank account, and feedback from the participants was that it felt “easy and fast.” In addition, there will be strong pilot push to use DCEP in the Beijing 2022 Winter Olympic Games and throughout the various 2022 Olympic venues.

Furthermore, the Digital Currency Research Institute of the PBoC has already reached strategic cooperation with a number of companies to jointly promote various DCEP pilot tests. The participating companies included omnipresent Chinese companies such as JD Digits, Didi Chuxing, State Grid Xiong’an Financial Technology Group, Lakala, and UnionPay. During China’s widely popular Double 12 (December 12) Shopping Festival (similar to Black Friday in the U.S.), JD’s online platform received nearly 20,000 orders by DCEP in the first 24 hours. With China’s hyper-integrated platforms and the success of the pilot programs, it is not difficult to imagine that DCEP will be easily adopted by Chinese consumers once it is officially launched.

7. DCEP and cross-border payment

On December 4, 2020 Hong Kong Monetary Authority (HKMA) announced that the PBoC and HKMA were preparing to test the use of digital RMB for cross-border payments.[2] In addition, the establishment of the joint venture in Beijing amongst SWIFT and the various PBoC-related entities on January 16, 2021 is another signal that China may be exploring the internationalization of DCEP.

Under the framework designed by PBOC, digital RMB could operate as China’s own cross-border banking system independent from the SWIFT system.[3] As shown in the figure below, Chinese residents could use the DCEP wallet to settle payment with offshore businesses as long as the offshore business has also opened a DCEP wallet account. With the exception of Hong Kong, the timing of using DCEP for cross-border payments may be uncertain as this would require coordination with central banks or payments supervisory authorities in foreign countries. Nonetheless, it is not hard to imagine that DCEP may soon be used in countries that are part of the One Belt One Road initiative in the not-so-distant future.

8. Transparency, Data Protection, and Cybersecurity

DCEP adopts the concept of “controllable anonymity.” This means when using DCEP, the transaction itself would be private to the outside world, but China’s PBoC would still be able to trace every movement of DCEP given its electronic footprints and by monitoring activities of digital wallets.

However, use of DCEP could raise issues around data protection and cybersecurity. The current Law of the People’s Bank of China and Regulation on the Administration of Renminbi does not contain any protection of a user’s personal information. Under China’s current Cybersecurity Law, personal information is protected, although there are no specific rules targeting personal information collected during the use of DCEP. In addition, it remains to be seen if DCEP will be characterized as “critical infrastructure” under China’s Cybersecurity Law, thereby affording it protection applicable to critical infrastructure and subject to special regulations.

With the launch of DCEP, the expectation is additional regulations and standards would follow to address the cybersecurity risks and user data leakage that may arise from use of the digital currency.

9. Key implications for foreign businesses and financial institutions in China

While it is still early for DCEP, foreign companies operating in China, hi-tech businesses, foreign invested retailers, financial institutions, and mobile app developers would need to closely track the development and acceptance of DCEP, monitor any arising risks, assess how their financial and fintech products fit within the new DCEP ecosystem, adjust China-related business operations to support or limit the use of DCEP, and adjust reporting requirements and financial reserves required due to DCEP use.

In particular, some of the immediate effects of DCEP will be:

- DCEP will challenge the duopoly of Alipay and WeChat Pay;

- China’s commercial banks will play an important role within the digital yuan ecosystem; instead of linking one’s bank account to WeChat Pay or Alipay, one can use DCEP through electronic wallets directly from their bank app;

- Any company that plans to do business at the 2022 Beijing Winter Olympics should expect to use DCEP then. For those companies, it may be prudent to start evaluating use of DCEP within your company’s internal system and any risks (reporting, compliance, cybersecurity, data privacy, etc.) associated with it;

- For foreign companies that are consumer-facing in China, evaluate whether Chinese consumers will push for DCEP use and analyze whether business will be negatively impacted if DCEP is not used;

- In the event DCEP will be used, develop internal controls for cybersecurity and data protection; and

- Fintech companies and financial institutions should keep an eye on further innovations and new regulations relating to or brought by the use of DCEP and evaluate DCEP’s impact on your operations and product offerings in China.

As China formulates more laws, regulations, standards, and/or guidelines on the digital yuan and the circulation and use of DCEP, we will continue to provide updates.

[1] The Bahamas and Cambodia have already launched their own central bank digital currency.

[2] Payment between Hong Kong and Mainland China is regarded as cross-border payment given China’s RMB administration and foreign exchange control.

[3] As the joint venture with SWIFT was just formed, it is not clear what role the joint venture may play with respect to DCEP. Nonetheless, DCEP may be used for cross-border payments in a number of different ways.