New Disclosure Requirements to Consider for 2022 Fiscal Year End, the 2023 Proxy Season and Beyond

17 minute read

January.26.2023

2022 was a busy year in rulemaking for the Securities and Exchange Commission (SEC). As a result, there are many new disclosure requirements for companies to keep top of mind as they work through this year’s annual report, proxy season and related disclosure matters. We have prepared the below checklist to help ensure these new SEC disclosure requirements are considered and addressed as part of an already thorough annual review and form check process.

Universal Proxy Rules

On November 17, 2021, the SEC adopted rule and form amendments to the proxy rules, requiring the use of a “universal proxy card” in contested elections of directors, except those involving registered investment companies and business development companies, and imposed new voting options applicable to all director elections (Universal Proxy Rules). These amended rules apply to all shareholder meetings held after August 31, 2022. See below for a brief summary of new disclosure obligations (assuming there is not a contested election),[1] compliance dates and disclosure locations:

|

New Disclosure |

Disclosure Location(s) |

Compliance Date(s) |

|

Source: New Rule 14a-5(e)(4) of the Securities Exchange Act (Exchange Act); Proxy Rules C&DI #139.03 Action Item: Disclose the deadline for dissident shareholder(s) to provide notice of director nominees for election at the next annual meeting. The default deadline is “no later than 60-calendar days prior to the anniversary of the previous year’s annual meeting date.” However, this 60-calendar day period is a minimum, not a maximum, notice period. Accordingly, if a company’s advance notice bylaw provides a deadline of 61 calendar days or more for such notice, disclosure of the earlier advance notice bylaw deadline (instead of the default 60-calendar day deadline) will satisfy this Rule 14a-5(e)(4) obligation. Additionally, if the advance notice bylaw has not been amended to reflect the Universal Proxy Rules, the proxy statement disclosure must also state the need for a dissident shareholder to comply with the Universal Proxy Rules. A sample statement is shown below, which could be included where the other deadlines required by Rule 14a-5(e) are disclosed: “Shareholders who intend to solicit proxies in support of director nominees other than the company’s nominees must comply with the additional requirements of Rule 14a-19(b).”

|

|

|

|

Source: Amended Schedule 14A, Item 21. Voting Procedures, Section (b) Action Item: Ensure voting procedures disclosure conforms with amended Schedule 14A, Item 21. Voting Procedures, Section (b). Specifically, ensure the voting procedures disclosure now addresses the treatment and effect under applicable state law and company charter and bylaw provisions of a “withhold” vote in an uncontested director election or as otherwise applicable.

|

|

|

|

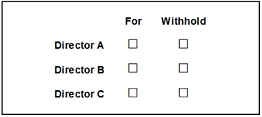

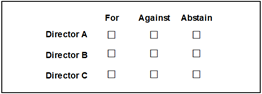

Source: Amended Rule 14a-4(b) Action Item: Ensure voting options on proxy card conform with amended Rule14a-4(b), specifically:

|

See Note to Rule 14a-4(a)(3). |

|

The SEC announcement, fact sheet and final rule text for the Universal Proxy Rules are available here, here and here, respectively. Our Q&A about the Universal Proxy Rules is available here.

Pay Versus Performance Rules

On August 25, 2022, the SEC adopted a final rule requiring companies (other than emerging growth companies, registered investment companies or foreign private issuers) to provide clear disclosure of the relationship between executive compensation and company financial performance (PvP Rules) through new tabular and other prescribed disclosures beginning with the 2023 proxy season. See below for a brief summary of the new disclosure obligations, compliance dates and disclosure locations:

|

New Disclosure |

Disclosure Location(s) |

Compliance Date(s) |

|

Source: New Item 402(v) of Regulation S-K Action Item: Provide annual disclosure consisting of:

Permits scaled disclosure for smaller reporting companies. |

Not included in other filings requiring disclosure under Item 402 (such as Form10-K and registration statements). |

|

The SEC announcement, fact sheet and final rule text for the PvP Rules are available here, here and here, respectively. Our alert summarizing the PvP Rules is available here.

Recovery of Erroneously Awarded Compensation Rules

On October 26, 2022, the SEC adopted long-awaited recovery of erroneously awarded compensation rules (Clawback Rules). The new disclosure obligations thereunder are generally not applicable for this proxy season as they will not become applicable until shortly after the national securities exchanges (such as Nasdaq and NYSE) adopt conforming listing standards. The exchanges are required to file proposed listing standards no later than February 24, 2023, and such listing standards are to be effective no later than November 28, 2023. Companies are required to adopt a compliant clawback policy no later than 60 days following the date on which the applicable listing standards become effective (which will be no later than January 27, 2024). While compliance will generally not be required until late 2023 or early 2024, as a technical matter new checkboxes should be added to the cover of any Form 10-K filed on or after January 27, 2023, as provided below.

|

New Disclosure |

Disclosure Location(s) |

Compliance Date(s) |

|

Source: Amended Form 10-K Cover Page Action Item: Add the following two checkboxes to the cover of Form 10-K, immediately before the text “Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act)”: If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. □ Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). □ Unless the SEC provides guidance otherwise, the addition of these checkboxes is a technical compliance matter only. Companies will not actually need to consider whether the checkboxes must be checked and/or, if appropriate, actually check them until the corresponding disclosure obligations of the Clawback Rules become effective, as explained above. |

|

|

Companies should still become familiar with the other new obligations and corresponding compliance dates that will begin to apply shortly after the national securities exchanges adopt conforming listing standards, summarized in Appendix A hereto for reference.

The SEC announcement, fact sheet and final rule text for the Clawback Rules are available here, here and here, respectively. Our alert summarizing the Clawback Rules is available here.

Rules to Enhance Investor Protections Concerning Insider Trading

On December 14, 2022, the SEC adopted changes to the rules governing insider trading defenses, including amendments to Rule 10b5-1, new required disclosure regarding Rule 10b5-1 trading arrangements and insider trading policies and procedures, as well as amendments regarding the disclosure of the timing of certain equity compensation awards and reporting of gifts on Form 4 (collectively, the Amended Insider Trading Rules). While the new conditions for valid 10b5-1 plans will begin to apply February 27, 2023, many of the corresponding disclosure obligations imposed by the Amended Insider Trading Rules are generally not applicable for this proxy season. See below for a brief summary of the new disclosure obligations to take effect this year, compliance dates and disclosure locations:

|

New Disclosure |

Disclosure Location(s) |

Compliance Date(s) |

|

Source: Amended Exchange Act Rule 16a-3 Action Item: Section 16 reporting persons must begin reporting dispositions of bona fide gifts of equity securities on Form 4 (rather than Form 5) in accordance with Form 4’s filing deadline (that is, before the end of the second business day following the date of execution of the transaction). Any dispositions of bona fide gifts of equity securities made before February27, 2023, will remain reportable on Form 5 within 45 days after the end of the fiscal year in which the gift is made (not within two business days after February 27). |

|

|

|

Source: Amended Form 4 and Form 5 Instructions Action Item: Add the following checkbox to the cover of Form 4, immediately below the text “Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b)”: □ Check this box to indicate that a transaction was made pursuant to a contract, instruction or written plan that is intended to satisfy the affirmative defense conditions of Rule 10b5-1(c). See Instruction 10. Add the following checkbox to the cover of Form 5, immediately below the text “Form 4 Transactions Reported” (underline added where text differs from the Form 4 checkbox text): □ Check this box to indicate that a transaction was made pursuant to a contract, instruction or written plan for the purchase or sale of equity securities of the issuer that is intended to satisfy the affirmative defense conditions of Rule 10b5-1(c). See Instruction 10. When checked, filers will also be required to provide the date of adoption of the Rule 10b5-1(c) plan in the “Explanation of Responses” portion of Form 4 and Form 5. |

|

|

|

Source: New Item 408(a) of Regulation S-K Action Item: Provide quarterly disclosure regarding adoption, modification or termination of Rule 10b5-1 plans and certain other trading arrangements by directors and officers during the covered fiscal quarter. Include a description of material terms such as the name and title of the director or officer, the date the arrangement was adopted or terminated, the duration of the arrangement and the number of securities to be purchased or sold pursuant to the arrangement. |

And Form 10-K, Part II, Item 9B. Other Information. |

|

Companies should still become familiar with the other new obligations and corresponding compliance dates that will generally apply for next proxy season, summarized in Appendix A hereto for reference.

The SEC announcement, fact sheet and final rule text for the Amended Insider Trading Rules are available here, here and here, respectively. Our alert summarizing the Amended Insider Trading Rules is available here.

Other New Disclosure Requirements and Updates to Consider

|

Disclosure |

Disclosure Location(s) |

Compliance Date(s) |

|

Source: Amended Exchange Act Rule 14a-3(c) Action Item: Furnish a PDF copy of the annual report delivered in satisfaction of Exchange Act Rule 14a-3(b) via EDGAR under “Form ARS” no later than the later to occur of (a) the date such report is sent or given to securityholders or (b) the date on which preliminary copies, or definitive copies, if preliminary filing was not required, of the proxy statement and related solicitation materials are filed. The SEC may have intended for this obligation to apply only to “glossy annual reports” or “10-K wraps” containing Exchange Act Rule 14a-3(b) information. However, absent clarifying guidance from the SEC, the best practice is to furnish any “glossy annual report,” “10-K wrap” or “Integrated Annual Report”[4] delivered to securityholders. The SEC announcement, fact sheet and final rule text for this rule are available here, here and here, respectively. |

|

|

|

Source: Amended Rule 144(h) of the Securities Act of 1933 Action Item: Form 144 for sales of securities of companies subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act must begin to be filed via EDGAR. The SEC announcement, fact sheet and final rule text for this rule are available here, here and here, respectively. The SEC has also released FAQs and other information about the transition to EDGAR filing of Form 144 here. |

|

|

|

Source: Nasdaq Rules 5605(f) and 5606

Action Item: Each company listed on The Nasdaq Global Select Market, The Nasdaq Global Market or The Nasdaq Capital Market must now have, or explain why it does not have, at least one diverse (as defined by Nasdaq) director. This disclosure augments the existing requirement to disclose the current year and immediately prior year diversity matrix.[6] |

|

|

|

Source: Exchange Act Rule 14a-21(b) and Schedule 14A, Item 24. Shareholder Approval of Executive Compensation Action Item: Consider the need to include the nonbinding “Say-on-Frequency” proposal, as required by Exchange Act Rule 14a-21(b), to vote on how often the “Say-on-Pay” vote should occur: every one, two or three years. Generally, this “Say-on-Frequency” vote is required every sixth calendar year after the immediately preceding “Say-on-Frequency” vote. So for companies that held their last “Say-on-Frequency” votes in 2017, the “Say-on-Frequency” vote should likely be on the ballot again during the 2023 proxy season. Notable Exceptions: Emerging growth companies are exempt. The SEC announcement, fact sheet and final rule text for this rule are available here, here and here, respectively. An SEC “investor bulletin” about the “Say-on-Pay” and “Say-on-Frequency” votes is available here. |

|

|

* * *

If you have any questions regarding these new disclosure obligations, please contact one of the listed authors of this article, or your regular Orrick contact.

Appendix A

New Clawback Rules to Keep in Mind for Next Season

|

New Disclosure |

Disclosure Location(s) |

Compliance Date(s) |

|

Source: New Item 402(w) of Regulation S-K Action Item: If an accounting restatement occurred during or after the last completed fiscal year, provide annual disclosure about whether and how the company’s executive compensation clawback policy was applied, including any recovery efforts. For most companies, this disclosure could be incorporated by reference from the annual meeting proxy statement on Schedule 14A, pursuant to General Instruction G(3) of Form 10-K. |

And Schedule 14A, Item 8. Compensation of Directors and Executive Officers. |

|

|

Source: New Instruction 5 to Item 402(c) and Instruction 5 to Item 402(n) of Regulation S-K Action Item: If any compensation was actually recovered, reduce corresponding Summary Compensation Table amounts to reflect the recovery and identify such recovered amounts by footnote to the Summary Compensation Table. |

And Schedule 14A, Item 8. Compensation of Directors and Executive Officers. |

|

|

Source: New Item 601(b)(97) of Regulation S-K Action Item: File a copy of the compensation clawback policy as Exhibit 97 to Form 10-K. |

|

|

Amended Insider Trading Rules to Keep in Mind for Next Season

|

New Disclosure |

Disclosure Location(s) |

Compliance Date(s) |

|

Source: New Item 408(b)(1) of Regulation S-K Action Item: Provide annual disclosure of whether or not (and if not, why not) the company has adopted insider trading policies and procedures that govern the purchase, sale or other disposition of company securities by directors, officers and employees that are reasonably designed to promote compliance with insider trading laws, rules and regulations. For most companies, this disclosure could be incorporated by reference from the annual meeting proxy statement on Schedule 14A, pursuant to General Instruction G(3) of Form 10-K. |

And Schedule 14A, Item 7. Directors and Executive Officers. |

|

|

Source: New Item 402(x) of Regulation S-K Action Item: Provide annual disclosure consisting of:

For most companies, this disclosure could be incorporated by reference from the annual meeting proxy statement on Schedule 14A, pursuant to General Instruction G(3) of Form 10-K. |

And Schedule 14A, Item 8. Compensation of Directors and Executive Officers. |

|

|

Source: New Item 408(b)(2) of Regulation S-K and New Item 601(b)(19) of Regulation S-K Action Item: File a copy of any insider trading policies and procedures, or amendments thereto, as Exhibit 19 to Form 10-K. Alternatively, if the insider trading policies and procedures are included in a code of ethics, and the code of ethics is filed as an exhibit to the annual report (permitted by 406(c)(1) of Regulation S-K), the filing requirement would be satisfied. |

|

|

[1] In the event of a contested election, additional Universal Proxy Rule disclosures would apply. Our Q&A about the Universal Proxy Rules is available here.

[2] However, companies will not need to evaluate whether these checkboxes must be checked until compliance with the underlying rules is required, as explained in greater detail below.

[3] For a company with a December 31 fiscal year end, this will be first required in the 10-Q filed for the fiscal quarter ending June 30, 2023.

[4] An “integrated annual report” as permitted under Exchange Act Rule 14a-3(d) and General Instruction H to Form 10-K—is a Form 10-K that includes all of the information required by Rule 14a-3(b). In such case, the company would furnish a pdf of the entire 10-K under “Form ARS” to satisfy this requirement.

[5] Applies only to companies listed on The Nasdaq Global Select Market, The Nasdaq Global Market or The Nasdaq Capital Market.

[6] So long as the prior year matrix remains publicly available elsewhere (i.e., a proxy statement or company Web site) the company can choose to disclose the current year matrix only. Nasdaq Q&A ID 1753, published 4/26/2022.

[7] If providing the disclosure on a Web site, you must submit the disclosure concurrently with the filing of the annual meeting proxy statement and submit a URL link to the disclosure either through the Nasdaq Listing Center or via an e-mail to [email protected], within one business day after such posting.

[8] For a company with a December 31 fiscal year end, this will be first required in the 10-K for the fiscal year ending December 31, 2024, and the 2025 annual meeting proxy statement on Schedule 14A.