SEC Climate-Related Disclosure Rules: Highlights, Data Insights, and Key Action Items

10 minute read | March.08.2024

The SEC has finalized its long-awaited climate-related disclosure rules. The final rules are consistent with what we believe institutional investors were looking for with respect to climate-related risk oversight and have many of the concessions public companies were seeking. Companies who have already aligned their sustainability reporting with the recommendations of the Task Force on Climate-related Financial Disclosures will benefit from consistency between those recommendations and the final rules. However, many public companies across the board will likely have to invest time and resources to prepare for the final rules. The final rules also provide for complex financial statement disclosure requirements, which financial reporting teams will have grapple with.

We have provided highlights from the final rules, related data insights that provide a view into current market practice, and action items for public companies. Included at the end of this discussion is a more comprehensive description of the key aspects of the final rules and deviations from the proposed rule.

|

Orrick Data Insights[1] |

|

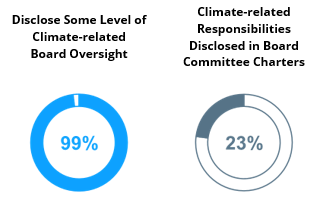

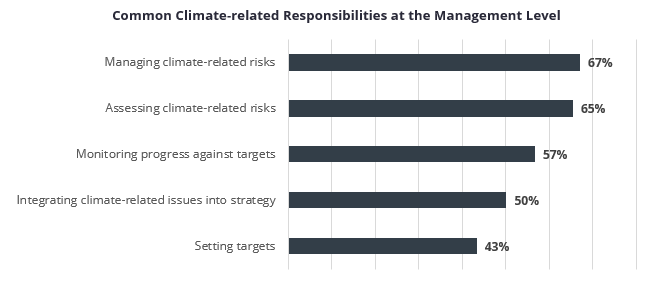

99% disclose some level of board oversight, but only 23% have climate-related responsibilities specifically included in their board committee charters[2] Over 70% disclose primary responsibility for managing climate-related risks at the C-Suite level 95% already have climate-related risks factors in their 10-K[3] 44% disclose having a climate transition plan aligned with a 1.5° C world 96% disclose that climate-related risks are considered as part of their financial planning 91% have a GHG |

Highlights

- The final rules introduce a materiality threshold for disclosure of Scope 1 and Scope 2 greenhouse gas (“GHG”) emissions and climate-related targets and goals, among other things.

- The final rules do not include a requirement for disclosure of Scope 3 GHG emissions.

- The final rules require disclosure of any oversight by the board of directors of climate-related risks.

- The rules require disclosure of management’s role in assessing and managing material climate-related risks, including disclosure of relevant management-level climate expertise.

- The final rules provide a safe harbor for disclosures pertaining to transition plans, scenario analysis, internal carbon pricing, and targets/goals. All information required to be disclosed under these sections of the rules, except historical facts, is considered a forward-looking statement.

- Financial statement effects disclosure is required for specific costs, expenditures, charges, and losses due to severe weather events and natural conditions; no financial statement effects disclosure is required for transition risks.

Timeline

The final rules will become effective 60 days after publication in the Federal Register, and compliance will be phased in as follows:

|

Compliance Dates under the Final Rules1 |

|||||||

|

Registrant |

|

Disclosure and |

GHG Emissions and Assurance2 |

Electronic |

|||

|

|

All new |

Disclosures |

Scopes 1 and 2 |

Limited |

Reasonable |

Inline XBRL |

|

|

Large Accelerated Filers (LAFs) |

|

FYB 2025 |

FYB 2026 |

FYB 2026 |

FYB 2029 |

FYB 2033 |

FYB 2026 |

|

Accelerated Filers (AFs) - other than SRCs and EGCs |

|

FYB 2026 |

FYB 2027 |

FYB 2028 |

FYB 2031 |

N/A |

FYB 2026 |

|

Non-Accelerated Filers, SRCs, and EGCs |

|

FYB 2027 |

FYB 2028 |

N/A |

N/A |

N/A |

FYB 2027 |

|

1. As used in this chart, “FYB” refers to any fiscal year beginning in the calendar year listed. |

|||||||

Action Items for Public Companies

We suggest companies consider taking the following steps to prepare for compliance with the final rules:

-

Start Now: Begin preparations now for the first reporting year under the final rules. Determine whether the company wants to implement additional climate-related initiatives before the first reporting year and conduct a disclosure “dry run” to identify gaps between current voluntary disclosures and the new SEC requirements, as well as the requirements of other climate-related disclosure laws that may apply.

-

Apply Materiality Thresholds: Given that the final rules make a number of disclosures subject to a materiality determination, confirm or develop the company’s approach to applying SEC materiality principles to Scope 1 and 2 GHG emissions and climate-related measures such as the company’s transition plan, scenario analysis, and climate-related targets and goals, as applicable.

-

Establish Oversight: Develop a climate oversight structure at both the board and management level and consider delegating oversight to a board committee and creating a management-level ESG Steering Committee or Climate Working Group. Consider how you are leveraging internal or external climate expertise in exercising management-level oversight, whether through individual personnel or through a management-level committee.

Orrick Data Insights

Nearly every company in the S&P 500 has established oversight of climate-related matters at the board-level, but companies have taken different approaches when formally establishing board and committee responsibilities in relevant charters. Additionally, current approaches for setting defined management-level responsibilities on climate vary significantly from company to company.

Nearly every company in the S&P 500 has established oversight of climate-related matters at the board-level, but companies have taken different approaches when formally establishing board and committee responsibilities in relevant charters. Additionally, current approaches for setting defined management-level responsibilities on climate vary significantly from company to company.

-

Develop a Climate Playbook: Create a comprehensive Climate Playbook outlining actions to be taken in current and upcoming years to comply with the final rules and other climate-related disclosure laws that may apply.

-

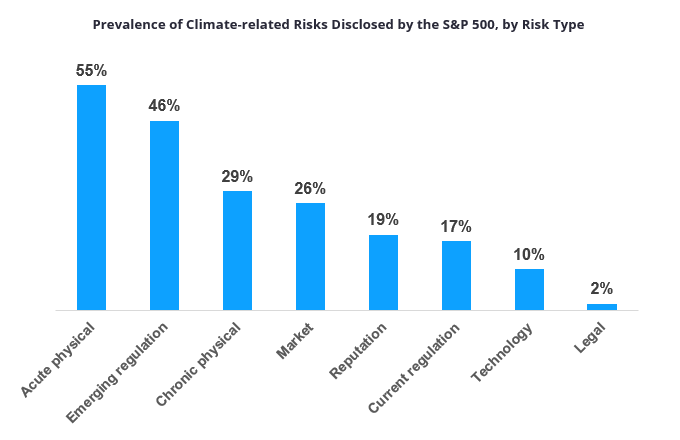

Conduct a Risk Assessment: Utilize existing risk management processes and third-party expertise to complete a climate-related risk assessment. Incorporate these results into the overall risk management processes. Establish (or refine) the framework for determining materiality of climate-related risks, incorporating input from counsel, advisors, and internal risk and governance committees.

Orrick Data Insights

While 95% of the entire S&P 500 have recently disclosed climate-related risks factors in their 10-K, the specific types of climate-related risks identified vary based on the company. There is no clear one-size-fits-all approach to climate-related risks; based on CDP data, we found that the types of climate-related risks, including the types of physical and transition risks, vary significantly from company to company.

-

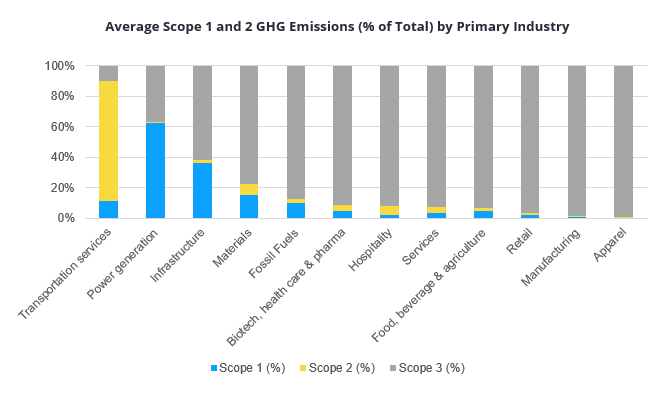

GHG Inventory Management Plan: Where GHG emissions are or could be material, establish a control environment for measuring GHG emissions, ensuring consistency in disclosures and recording changes in relevant data collection processes and estimates. Companies should consider relevant emissions inventory methodologies, as sources of material GHG emissions vary significantly based on the industry.

Orrick Data Insights

A GHG emissions inventory is highly dependent on the relevant industry, location in the value chain, and specific business activities. For most companies, Scope 1 and 2 GHG emissions are likely to account for a significant minority of total GHG emissions, once accounting for emissions in the value chain.

-

Prepare for Third-Party Attestation: Where GHG emissions are or could be material, enlist a consultant for a pre-assurance assessment and initiate discussions to secure an independent attestation provider as soon as possible.

Key Aspects of the Final Rules

The final rules require public companies to include the following information in their registration statements and annual reports:

- Any existing board oversight of climate-related risks and of progress against material climate-related targets/goals and transition plans;

- Any existing management oversight of material climate-related risks, including disclosure of relevant management-level climate expertise, and any related identification, assessment, and management processes for such risks;

- Identified material climate-related physical and transition risks in the short term (next 12 months) and long term (beyond 12 months), along with their potential impacts on strategy, business model, and outlook, and how these impacts influence company strategy, financial planning, and capital allocation;

- Any activities undertaken to mitigate or adapt to material climate-related risks, including quantitative and qualitative details of associated expenditures and impacts on financial estimates, and the use, if any, of transition plans, scenario analysis, or internal carbon prices;

- Climate-related targets and goals with a material impact on the company's business, operations, or financial condition, if any, including related expenses and financial outcomes; and

- For Large Accelerated Filers (LAFs) and Accelerated Filers (AFs), and only to the extent material, Scope 1 and/or Scope 2 historical GHG emissions and intensity metrics, coupled with the methodology, significant inputs, and significant assumptions used to calculate such information.

LAFs and AFs required to make Scope 1 and/or Scope 2 GHG emissions disclosures must additionally obtain an attestation report for these disclosures. They must also disclose whether the GHG emission attestation engagement is subject to any oversight inspection program, and provide disclosure about any changes in, or disagreements with, the GHG emissions attestation provider. The final rules also require any issuer, not just LAFs and AFs, that offers GHG emissions disclosures and voluntarily subjects them to assurance, to disclose specific additional details about that voluntary assurance engagement.

As indicated above, the final rules provide a safe harbor for disclosures pertaining to transition plans, scenario analysis, internal carbon pricing, and targets/goals. All information required to be disclosed under these sections of the rules, except historical facts, is considered a forward-looking statement.

The final rules also require public companies to provide disclosure in the notes to their financial statements covering the following:

- Costs, expenses, charges, and losses resulting from severe weather events and natural conditions like hurricanes, tornadoes, flooding, droughts, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds;

- Costs, expenses, and losses linked to carbon offsets and renewable energy credits or certificates (RECs) if they play a material role in achieving disclosed climate-related targets or goals; and

- If severe weather events, natural conditions, disclosed climate-related targets, or transition plans materially affect the estimates and assumptions used in producing financial statements, a qualitative description of how the development of such estimates and assumptions was impacted.

All climate-related disclosures must be tagged in lnline XBRL. Foreign private issues must provide analogous disclosures, but asset-backed issuers are exempted from compliance.

How the Final Rules Differ from the Proposal

Key departures from the proposal include:

- Making certain climate-related disclosures subject to a materiality determination, including disclosures regarding Scope 1 and Scope 2 GHG emissions, transition plans, scenario analysis, the use of a carbon price, and climate-related targets and goals;

- Removing the requirement to describe board members’ climate expertise;

- Limiting Scope 1 and Scope 2 emissions disclosure to LAFs and AFs, phased in and only when material, with exemptions for SRCs and EGCs;

- Adjusting assurance requirements for Scope 1 and Scope 2 emissions, allowing a longer phase-in period for obtaining reasonable assurance by LAFs and requiring only limited assurance for AFs;

- Permitting Scope 1 and Scope 2 emissions disclosure to be filed on a delayed basis;

- Eliminating the Scope 3 emissions disclosure requirement;

- Dropping the requirement to disclose the impact of severe weather events and natural conditions on each financial statement line item;

- Refocusing financial statement effects disclosure on specific costs, expenditures, charges, and losses due to severe weather events and natural conditions;

- Requiring disclosure of material expenditures related to climate-related activities in the body of annual reports and registration statements, instead of in notes to the financial statements;

- Scrapping the requirement for private companies involved in business combination transactions to provide the required climate-related disclosures; and

- Removing the need to disclose material changes to climate-related disclosures on a quarterly basis.

Although the final rules have reduced the expected disclosure burden for public companies in many ways, complying with the SEC's new climate disclosure rules, along with potential overlapping or conflicting requirements from other jurisdictions, will nonetheless be a significant lift for many companies. Orrick stands ready to act as a valuable partner in navigating this evolving disclosure landscape. Orrick has been helping companies develop climate reporting playbooks and serving as an outsourced sustainability reporting function with respect to various climate-related reporting requirements and can provide practical insights regarding how companies can integrate the requirements of the final rules into their internal sustainability reporting systems and prepare for disclosure. Please contact one of the listed authors of this article or your regular Orrick contact for additional information.

Learn More

SEC news release

SEC fact sheet

SEC final rules

Related SEC guidance from 2010 remains in place.

[1] Unless otherwise noted, Orrick Data Insights included in this Client Alert are based on Orrick analysis of publicly available 2023 CDP Climate Questionnaire responses from 367 U.S.-based companies in the S&P 500.

[2] The 23% figure is based on the entire S&P 500, not limited to CDP response data, and covers disclosure since March 2021.

[3] The 95% figure is based on the entire S&P 500, not limited to CDP response data, and covers disclosure since March 2021.