The Download: Market Outlook with TD Cowen & Is the Death Spiral a Myth?

7 minute read | December.17.2024

WHAT WE'RE SEEING

01 A Solid Outlook for the Tech Capital Markets

02 Is the Death Spiral a Myth?

03 The Download Quiz: U.S. vs. European Venture Capital Trends

A Solid Outlook for the Tech Capital Markets in 2025

-

Albert Vanderlaan: Joining me today is Chris Weekes from TD Securities. I'll give him a moment to introduce himself. Chris Weekes: Thanks. Chris Weekes, managing director at TD Cowen, in the Equity Capital Markets Group. I have been here at TD Cowen for about 14 years and in the industry for about 22. Albert: I'm really excited to be here with you today for two reasons. One, we've never been in the same room together, so it’s awesome to finally be able to do that. But the second reason is that earlier this year, you and I had the pleasure of doing a webinar together where we gave some anticipated insights into what was going to be happening during the IPO market for 2024.

At this point, we're nearly all the way through the year. Thanksgiving's coming up next week. From that perspective, we thought it would be great to be able to revisit a little bit of what happened during the year. Give me a little bit of context and what you think we were right on, what we were wrong on, and how we interpreted what happened during 2024.

Chris: At this point, we're nearly all the way through the year. Thanksgiving's coming up next week. From that perspective, we thought it would be great to be able to revisit a little bit of what happened during the year. Give me a little bit of context and what you think we were right on, what we were wrong on, and how we interpreted what happened during 2024. Albert: Yeah, the pandemic levels still seem to be a blip, to say the least. In terms of the issuances that we did see this year, was it mostly the playbook that we saw prior to the pandemic coming back into the fold, or were there any changes or any market dynamics from that perspective? Chris: Yeah, pretty much the same goes. There were about 77 IPOs this year. We did have five IPOs that were for more than $1 billion, which was really nice to see. But the playbook was basically the same. Investors are still looking for growth and profitability. And those companies who could provide that are garnering premium valuations still. So, I would say generally the same. Things are starting to improve though, and I think investors are actually starting to get a little more comfortable with reverting to the sort of more growth, less profitability. I think that will start to evolve a little bit more as we go into 2025. Albert: Yeah, that's interesting. We've certainly heard from clients who were out talking to various folks that the metric to get into that IPO range is certainly increasing. It's good to hear that the growth is kind of coming back into play. I think a number of the backlog companies, at least from what we're seeing, are waiting for that to turn because they're not there from those metrics. Chris: Yeah. If you use software as a proxy, those companies, at least in the public markets today that are growing at 30% plus and are either breakeven or profitable (sort of in that still rule of 40 area), they're trading at anywhere between two- and three-times premium multiples to those that are non-profitable. There was one example though this year, which was Rubrik. There were two software IPOs this year. Only two, unfortunately. There were 10 tech IPOs but two software IPOs, OneStream and Rubrik. Rubrik was growing 30% plus but burning still a lot of cash. They were able to get out, but I would say valuation was not necessarily the premium that they would have liked had they been breakeven or profitable. OneStream was growing again, 30% plus and breakeven. And that was a secondary trade effectively from KKR with some primary as well. But that was another example of a premium valuation. Both traded really well and actually are up 30% or 40% since the IPO. So, two good examples, but we need about 25 more. Albert: When the rest of them come, it will be very telling. In terms of the factors this year that ended up continuing to be those headwinds, what were the main factors? And how do you think they played out? Chris: Rates and the election were everything through September. And some of that is still the same. The election is over. Investors are now trying to figure out with every cabinet election, what is going to happen. Rates, we’re actually still trying to figure out what's going to happen. But the Fed cut campaign has started. So, I think that investors and companies are getting more comfortable with what the future is going to look like in terms of how to manage the corporate balance sheets. And then some other headwinds, obviously, are the ones that have been there for a while, which is the macro with the Ukraine and the Middle East.

And then valuations. I mean, that's one bright spot. The public market, you know, equities have again rallied. The S&P is up 24% I think this year. A little bit of a nuance there. The S&P weighted is up 24%. The equal weighted S&P is up 13%. So that just means that there are a handful of stocks like NVIDIA and Google and the MAG 7 that have driven a lot of the outperformance. And so not everybody is participating in this, which is why I think we have seen muted new issuance still as well.

Albert: One thing you said that was interesting is that the new issuance, there's been quite an uptick in some of the other types of secondaries and other pieces of that. Can you talk a little bit about what the rest of the market looks like? Chris: Yeah, it's still down 30%. We've had 430 follow-on offerings between primary and secondary. About 75 to 80 convertible offerings. That's in line. It's actually today, exactly in line. There were 431. And I think there may be two that are going to price tonight. So perfectly in line with the year-to-date last year in terms of follow-on offerings. We use 2019 as a sort of normal year. There were 600 and something. So we're down still 30%. Look, I think next year the secondary market, meaning the follow-on and convertible market, will get back to those levels. I think IPOs, the sentiment is second half of next year… I feel like a broken record. I think we said this last year and the year before. It's sort of like cautiously optimistic. But we are seeing more, the pipeline is growing, public filings are growing, testing the waters. Our campaigns are ongoing, and we are speaking to a lot of sponsors, meaning private equity sponsors, the likes of Carlyle and KKR and others that have a little bit more pressure to exit and find exit and return capital to their LPs. And we're getting into that area where something might likely happen. And now with the backdrop, a lot based on the election result, a lot based on sort of what we see in terms of regulatory and certain sectors that are going to benefit from this, we definitely think that there are going to be more than 75 IPOs next year like we saw this year. But maybe not at 155 that we saw in 2019. Albert: Yeah, that's the sense that we're getting too. I mean, the bankers and the lawyers usually have a little bit of insight into that. And we've started to have clients pick up meetings and start going back out.

On the M&A side of things, we've also seen a pick-up. Is it still true that M&A is usually a good bellwether for the IPO market, because they usually travel kind of in tandem together?

Chris: I think it is. M&A is definitely going to pick up because you have a whole array of regulatory things, you got FTC, you got DOJ, all of that is going to come down. And like the IPO market for private equity sponsors, in the M&A market, there's a pent-up demand to buy assets. I think the M&A will be more private trades. Private equity sponsors trading with each other, not necessarily public to public companies. Just based on where valuations are now and where stocks are trading. But for sure, that is our expectation that M&A will pick up a lot and probably it will be more of a leading indicator for the IPO market. Albert: It makes sense. In terms of what else you're thinking from a sector industry perspective, do you think there's going to be one that picks up earlier? There's obviously a lot of talk about AI as a general catalyst for growth, etc. So, any insight you think might be pertinent for 2025, and let's just go with 2026? Chris: Yeah. Well, I'll go out on a limb. I think sector performance is going to be determined over the next couple of weeks by who is being elected to office. So you saw last week when RFK was initiated, the XBI (the ETF that tracks biotech) dropped 15% in a few days. So, a clear indication that the market says, uh oh, what's happening here now? So healthcare, sort of up in the air. Aerospace and defense, huge tailwind. Financials, huge tailwind. You've seen all of the big banks, JP Morgan, Goldman, all of the investment banks and the commercial banks, have been performing really well. That's deregulation, return of capital, buybacks, things like that. Technology? Look, Trump has been pretty vocal about certain areas of technology that he doesn't like, which I think there will be some beneficiaries of.

But generally speaking, we are moving into a lower rate environment. And so technology and especially small-cap tech should benefit from both the new administration and lower rates and frankly, small caps in general. Like I mentioned before, it's been a very narrow rally. We need a more robust set of companies that are participating in the rally to really have both the companies and also investors willing to take more risk. And that liquidity starts to build in small and mid-cap stocks. That's going to happen because small caps benefit from a lower rate environment.

Now the issue and I mentioned it before is that Powell, you know, we got a big bump coming out of the election the next couple days. And then Chairman Powell came out and said perfect, way to go. I'm not going to necessarily, you know, hit the gas pedal on lowering rates. There was a 50 basis point cut right before an election, but then it was 25. So we're 75 down, I think we're at four and a quarter to four and three-quarters, around there, so quite a ways to go. And I think they're going to take their time. However, again, investors and the equities market lead those decisions.

So I do think that the rally should be broader this year. And there's still room to go. I mean, another interesting one, the S&P weighted is trading at 21 times forward earnings, which if you look at a ten year, that's high. But the S&P equal weighted is trading at 18 versus 17 on a ten-year average. So it's not crazy. And valuations are higher. But there's still room to grow.

Albert: Makes sense. How does the retail market as it exists now post-pandemic play into any of those factors on either new issuance or just going forward, how that's going to be viewed by investors and especially the long holders? Chris: Oh, look, I think the retail community has become stronger and stronger every year. It's actually great because if you're focused in areas, put aside mega cap and large cap stocks, if you're focused in small and mid-cap stocks, the ability to generate liquidity and volume and things that give your capital markets profile some more credibility, whether it's retail or institutional capital coming in, doesn't matter. It helps.

I think retail has played a very big part in some of the stuff that I'm personally really excited about, which is disruptive technology. We are seeing a ton of stuff in space technology. We're seeing a lot, obviously, in AI. And really, really early days in AI. Not for NVIDIA. I mean, they had earnings last night and it's amazing what they're doing. But I think AI and how AI is now going to be utilized and how it plays into every other sector and every other aspect of our life is just going to be an incredible driver. And retail has been a big proponent of those types of stocks. Anything where you can sort of touch and feel as a human being, like a person on the street, you want to buy those things. If you're able to participate in the market, which more retail investors have been able to participate, those are the types of stocks that people tend to buy.

Albert: From that perspective, the regulatory landscape with AI is going to be really interesting under the new administration. Because if they're not going to do something at the federal level, it may be really determinative based on what the states are doing. California will be a leader there and how that interplays with it, and also how those states are interacting with the retail investors, etc. So there are a number of different regulatory overlays that I think will be really interesting to see how they deal with it over the next four years. Chris: This administration is not going to have a lot of regulation at the federal level, based on certain decisions that Trump already had made in his previous term. But also, just generally speaking, I think regulation is good. Especially when it comes to AI, when we're at the infancy of something and we don't quite perfectly understand it. Trying to facilitate and really understand how it can play a responsible role in sectors like utilities, power management, all the way down to the consumer when you walk in and your phone is telling you where to go to buy the thing that they know that you like. I mean, that's a little scary. But reality is, it kind of helps. Albert: Yeah. And it's already there in some aspects. But actually, that brings up another point that we've been thinking through here based on our intersection of energy and infrastructure and technology, the way that our firm is structured. We talk with AI clients all the time about future needs. There's a lot of talk about there just being a wall inherently. Are you seeing an uptick in energy and infrastructure projects and how that's being driven with data centers and those types of modalities that are going to come down the road too? Chris: Yeah. Billions and billions of dollars are being spent today to either repurpose real estate for power generation into data centers to drive GPUs and compute. You're seeing legacy Bitcoin miners turning into AI data farms. I say that seriously. And it's really interesting to see what's happening because it's a wonderful thing to see how the market can be efficient and actually take something that was maybe not perfectly fitted to then an entire technology that changes the entire landscape, kind of like the internet or the cell phone. This is a whole other structural change that is going to alter a lot of what we see in hard assets around the world. And so, we as a firm have been raising a tremendous amount of money around digital assets and the sort of digitalization of anything from what you talked about from power management to figuring out how to best make the at-the-well drill bit more efficient using AI. Albert: Well, I mean, that just shows the spectrum of what you can anticipate from it. So that's really interesting. Any final thoughts on where you think we're going to end up from 2025, 2026? What's going to be the outcome here from the next couple of years perspective? Chris: I wish I could say that I think we'll sit here in another nine months and the market will be up 25% again. I think the market will continue to go higher. I think the economic backdrop is solid. I think we are going to go through a period of some near-term volatility, based on policy changes and sort of the unknown as to what is to come. There are a lot of areas, though, that we're really excited about. I mentioned earlier, disruptive technology, things like automation. I do believe that the IPO market is going to return to what looks more normal in the second half of 2025. We are likely to see 25, 30, 40 IPOs in the April-May timeframe. And then I think really a reopening exit rate, sort of 120 to 130, by the end of the year next year. So we're pretty excited about it. Albert: Well, that sounds great. I really appreciate you taking the time and thank you. Chris: Appreciate it.

How will investor sentiment, the new Trump administration and disruptive technology influence the tech capital markets in 2025? Orrick’s Albert Vanderlaan hosts a conversation with Chris Weekes, Managing Director at TD Cowen.

3 Takeaways

- IPO activity is expected to increase given the lack of activity and backlog of IPO-ready companies. “The pipeline is growing,” Weekes says. “Our campaigns are ongoing, and we are speaking to a lot of private equity sponsors… that have a bit more pressure to find exit and return capital to their LPs.”

Weekes expects the capital markets to continue to rebound and the IPO market to return to a more normal state in the second half of 2025, resulting in about 120 to 130 IPOs by year’s end. - The regulatory scheme will look different. Expect some short-term volatility as the new Trump administration rolls out policy changes. However, the prospect of deregulation, paired with return of capital, is already accelerating activity in the tech, aerospace and defense and finance sectors, Weekes says.

There’s another important factor at play – in the absence of federal regulation, the states are likely to act, Vanderlaan says. - Disruptive technology will be a driver. New technologies such as AI, and its convergence with other sectors such as energy and infrastructure, will continue to drive growth – and the retail sector is playing a part, Weekes says.

Capital infusion into data center and energy infrastructure to support growth in the AI and tech sector more broadly is expected to increase in 2025 as the intersection of energy and tech continues to coalesce, Vanderlaan says.

Is the Death Spiral a Myth?*

(...too Convertible? That is the Question...)

Times are tough, and you need capital. Maybe your product or services roll-out is off schedule. Maybe expenses have soared or your business needs a little more capex – or time – to generate positive momentum. Maybe everything is going well, but your existing debt is approaching maturity and refinancing at current rates just isn’t feasible. Whatever the reason, your public company needs funding, and you don’t feel like you can access traditional debt or even private credit markets. Then, an investor knocks on your door with an offer – a twist on the old “equity line of credit” structure where an issuer has the right to periodically place its shares with an investor at a market discount.

The names vary – a “pre-funded advance,” “pre-advance loan” or a “convertible debenture,” among others – but the construct is largely the same. The investor advances capital in exchange for a short-term note (12-24 months) that is freely convertible into tradeable, listed equity at a discount to the trading price at the time of conversion, subject to a “floor price.” Unconverted principal is payable in cash at maturity. The note may be issued at a discount, could be secured and typically includes events of default and other provisions that might trigger repayment obligations or penalties. It can be issued one-off or under an agreement allowing for additional advances at the request of the issuer, up to a committed amount.

The direct benefits are apparent – the company will receive immediate cash that it can “repay” by issuing equity, ideally never having to come out of pocket. As are key downsides – with a conversion price that always scales down at some discount to market, a stock price decline could let the investor draw increasingly dilutive amounts of equity while barely putting a dent in the outstanding balance of the note. Ongoing sales of those shares (and/or prospective shorting activity) can put further pressure on the company’s stock price, potentially resulting in a “death spiral” effect that it cannot recover from.

So, are the benefits worth the risks? To investigate, Orrick’s Mark Mushkin reviewed the stock price performance of 65 unique issuers** who entered into similar instruments (some multiple times) over 100+ transactions from mid-2019 through late 2024.

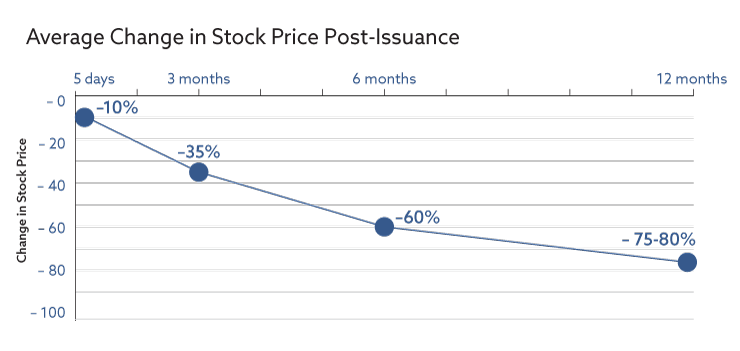

The results were fairly stark. While a handful experienced some short-term gains, on average, these issuers saw stock price declines of ~10% after five days, ~35% after three months, nearly 60% after six months and between 75% to 80% after one year.

In addition, of the issuers we looked at, more than 45 received a non-compliance notice from their listing exchange within an average of ~six months, 60%+ of which related to a failure to maintain a $1.00 minimum bid price, and 20%+ for other equity-linked reasons (min. stockholders’ equity; min. market value of listed securities), with 12 of the issuers we reviewed still short of six months post-issuance. In addition, of the 42 issuers for whom we have 12 months of post-issuance data, only one was trading up at 12 months (though a few had ups and downs along the way) and of the 12 issuers for whom we only have six months of data, only two were trading up at six months.

There are, as always, some caveats. By the time a company answers that fateful knock, these facilities may represent capital of last resort and the stock price declines we noted may be as much a function of a company’s performance as any downward pressure from the convertible security. At the same time, while their stock price suffered, many of these issuers seem to have bought more of that priceless resource – time.*** Of the entities we looked at, about two thirds are still trading on an exchange, the rest having either moved to OTC, been acquired or filed for insolvency. In addition, several issuers were able to secure multiple such advances, suggesting a slow (if steady) decline.

One clear takeaway? While companies may have turned to these instruments in the hope of using the capital to operate their way out of their doldrums, we did not find evidence of those outcomes – only five of our set are trading higher today than at the time of issuance. On the whole, even if these instruments did not speed the companies’ decline, they do not seem to have helped reverse it, either. That is not to say this could never work. A company facing liquidity issues must consider all options, and it is possible a savvy operator who just needs a bit more runway to their next milestone or deal could use an instrument like this to bridge the gap and put itself back on the path to success. But… as with all things – buyer beware. The details of the terms matter, so be sure to review closely with your counsel. And if it seems too good to be true? It very well might be.

*All figures based on rough lawyer math and stock price movements as of October 31, 2024. This analysis generally focuses on a particular type of converts – “future-priced” securities convertible at any time at the investor’s option at a discount to then-current market prices, as well as comparable structures that create a similar dynamic – which present unique concerns compared to more traditional convertible instruments with a fixed conversion price or conversion limits set at closing.

**To determine our issuers, we first identified a group of instruments with these features that were issued over the past 3+ years, then looked to each issuer’s stock price performance from its first such issuance on. There are likely a number of similar transactions (and issuers) we missed, but for trend purposes, there was enough consistency in the outcomes that we felt comfortable with the initial sample set.

***It is possible, however, that this dynamic could change in the future given the recent reforms adopted by the listing exchanges to expedite the delisting process for continuously non-compliant issuers.

A Closer Look will be a regular feature in The Download – as Mark Mushkin shares insights into the rapidly evolving ways issuers attract and raise capital. You can find his first post here: Do I Need to Make Money to Go Public?

Which sector received the largest share of European venture capital funding as compared to the U.S.?

A) Fintech

B) AI

C) Sustainability

D) Deep Tech