Japan Renewable Alert 53

Energy & Infrastructure Alert

April.20.2021

Generation Charge: Current Discussion and Future Outlook

There have been significant changes from the discussions we outlined in our Japan Renewable Alert 42 regarding the introduction of the generation charge (we referred to generation charge as “producer-side base charge (hatsuden-gawa kihon-ryokin)” at the time; from now on, however, we will use “generation charge (hatsuden-gawa kakin)” reflecting the current discussions). As the generation charge will affect cashflow for the entire duration of operations for all power sources, including FIT projects, it is a crucial issue that impacts profitability for developers, operators and investors of renewable projects and has prompted many recent inquiries from our clients. This Alert provides an outline of the current discussions.

1. Discussions in the Past

Currently, wheeling charges are collected by general power transmission and distribution services operators (“TDSOs”) from the demand side only (that is, electricity retailers pay wheeling charges and such charges are ultimately reflected in the electricity bill to be paid by consumers). In 2018, however, it was decided that a generation charge should be introduced and imposed on power producers to support grid upgrades in response to the increase in distributed energy resources (DERs) and projections of continued decreases in electricity demand. Initially, the generation charge was proposed as a capacity (kW-based) charge that would raise the low capacity-to-energy charge ratio and thereby alleviate the discrepancy with the high fixed-to-variable cost ratio of grid maintenance costs.

The impact of this new burden on power producers was outlined in a report that was drafted by the Working Group on Power Grid Maintenance and Operation Cost Burden (the “Working Group”) under the Electricity and Gas Market Surveillance Commission (“EMSC”) of the Ministry of Economy, Trade and Industry (“METI”). While the generation charge would give rise to new costs on the power producer side, the wheeling charge on the demand side would be reduced by the same amount. The national average of the new burden to be imposed on power sources of all kinds (i.e., the average reduction of the wheeling charge power retailers pay), according to METI’s materials, was estimated to be approximately JPY0.5/kWh with kWh conversion (please note that the actual amount will vary depending on TDSOs; please also note that the estimation was based on a simplified calculation using actual figures from 2015). Considering such allocation of grid costs, with respect to non-FIT projects (where electricity is wholesaled to electricity retailers from power producers; please see the structure shown in 4(1)), the Working Group assumed that the new burden on power producers would likely be passed through wholesale charges onto electricity retailers in the market or in negotiations between parties and concluded that the government should prepare guidelines to promote proper amendments to existing non-FIT wholesale agreements so that power producers would not be encumbered in existing bilateral contracts. On the other hand, with regard to FIT projects, the Working Group suggested that adjustment measures might be necessary considering that power producers would not be able to pass through any new costs arising from the generation charge because they had to sell their generated energy at fixed prices determined in advance during the FIT period under the FIT scheme.

As we reported in our Japan Renewable Alert 42 dated August 7, 2019, FIT adjustment measures were subsequently discussed by METI’s Subcommittee on Large-Volume Introduction of Renewable Energy and Next-Generation Electricity Network (the “Subcommittee”) in the summer of 2019. The Subcommittee members were roughly divided between the following three opinions: (i) that adjustment measures should be available to all FIT projects; (ii) that adjustment measures should be available to FIT projects other than solar projects that were approved early on in the FIT scheme, when procurement prices were calculated based on high IRRs (i.e., solar projects with a FIT price of JPY29/kWh or above); and (iii) that the necessity of adjustment measures should be carefully considered for all FIT projects. The Subcommittee appeared to be leaning in the direction of (ii), although not to the exclusion of (i) and (iii), in the third interim report it published on August 20, 2019 (the “Third Interim Report”), not long after we circulated Japan Renewable Alert 42.

2. Criticisms Related to the Above Discussion

In 2018, the Working Group originally concluded that it would be “fair” to impose the generation charge on a capacity (kW) basis for all projects. However, since power generation businesses principally earn profits from energy sold (kWh), a kW-based charge would impose a heavier burden on variable renewable energy (VRE) power sources (solar and wind power) that have lower capacity factors compared to conventional thermal power sources. Critics have raised concerns with respect to the Working Group’s claims of “fairness” because the external costs of conventional power sources are completely ignored (e.g., climate change and air pollution) while new technologies are disadvantaged by the system rendering uneven impact on power plants based only upon capacity factors.

In addition, after we circulated Japan Renewable Alert 42, many developers, owners and investors of FIT projects who contributed greatly to the introduction of renewables in Japan strongly argued that the new charge would substantively overturn the government’s previous assurances guaranteeing that the offtake price would not be changed.

Opinions were divided as well among members of the Procurement Price Calculation Committee, which took over the discussion on adjustment measures. One member insisted that the government had merely promised the price and not the cost, while another member pointed out that the entire basic premise of the FIT system was to promote the introduction of renewables through private investment by guaranteeing fixed conditions for the purchase of renewable energy.

METI aims to have the generation charge implemented in 2023, but how FIT power sources will be treated continues to remain uncertain.

3. Turnabout from kW-based Charge to a Combined kW and kWh-based Charge

As discussions stagnated, Hiroshi Kajiyama, the Minister of Economy, Trade and Industry, announced on July 3, 2020 that he had instructed METI to review the usage rules for regional trunk transmission lines (high voltage transmission lines within a grid region) and to review the mechanism of the generation charge as well so that it would be consistent with such usage rules (the “Minister’s Announcement”). The Minister’s Announcement represented a drastic shift in the government’s position on grid-related rules to further promote renewable energy. On October 26, 2020, Prime Minister Yoshihide Suga declared in his general policy speech at the opening of the Diet session that Japan would achieve carbon neutrality in 2050; further, in November 2020, the Task Force for Review of Renewable Energy Regulations (the “Task Force”) was organized under the Cabinet Office by Taro Kono, the Minister of State for Special Missions.

In Japan, basically all power projects are connected to the grid through firm connection, where power projects secure their right to capacity for input. Under this scheme, however, it is easy to reach a point where enhancement construction has to be undertaken to prevent the possibility of grid congestion, and new projects are impeded by massive construction charges and long waiting periods. To address such inefficiencies, the government and TDSOs have decided to introduce non-firm connection, whereby projects consent to the possibility of output curtailment in case of grid congestion. As of January 13, 2021, applications for non-firm connection are being accepted with respect to regional trunk transmission lines nationwide. As multiple projects will be connected to transmission lines on a non-firm basis, the rule to resolve grid congestion will be updated from the current first-come-first-served rule where older connected projects have priority over new projects, to a merit order rule whereby the energy generated from power sources with lower marginal costs such as renewables have priority over less competitive conventional power sources.

With respect to the review of the generation charge, at a meeting of the Expert Panel on Instrumental Arrangements (“Expert Panel”) under EMSC held on January 25, 2021, METI proposed a plan to shift from a kW-based generation charge to a combined kW and kWh-based generation charge in line with reforms to change conventional capacity-based interconnection rules. Members of the Expert Panel by and large approved METI’s proposal for an initial kW to kWh ratio of 1:1 (i.e., of the grid maintenance costs to be collected through the generation charge, half would be based on kW and half would be based on kWh) and agreed that a review could be conducted as needed after implementation. Where the capacity charge would have been JPY150/kW per month on average nationwide before this turnabout, the capacity charge is now expected to be JPY75/kW per month (approximately 0.25/kWh with kWh conversion) and the energy charge is expected to be JPY 0.25/kwh.

Adjustments to address the new burden imposed on FIT projects by the generation charge were discussed at the 57th meeting of the Expert Panel, held on March 2, 2021. Please see the next section for a summary of the current discussion on this issue.

4. Current Discussion on Adjustments

As mentioned above, the generation charge with kWh-conversion is estimated to be approximately JPY0.5/kWh on average nationwide for all power sources, and the wheeling charge that electricity retailers will pay to TDSOs is expected to be reduced by the same amount (please note that the actual amount will vary depending on TDSOs; please also note such estimate is based on a simplified calculation using actual figures from 2015; same hereinunder). The burden imposed on VREs is expected to be greater than the average of all power sources. More specifically, the charge for a facility with a capacity factor of 14% would be approximately JPY1.0/kWh, and approximately JPY0.7/kWh for a facility with a capacity factor of 23% (the figures were JPY1.5/kWh and JPY0.9/kWh, respectively, before the turnabout to a combined kW and kWh-based charge). Below, the burden newly imposed on power producers due to the generation charge is divided into the burden on average among all power sources (hereinafter referred to as the “Average Burden”) and the extra burden imposed on renewables (hereinafter referred to as the “Extra Burden”).

(1) Existing Agreements for Non-FIT Projects

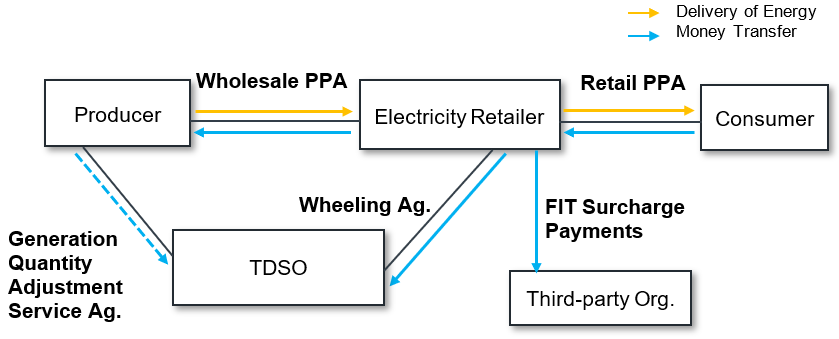

With respect to the existing non-FIT bilateral power purchase agreement (PPA) (see below figure for basic contractual relationships; the offtaker of a project is a retailer), METI is going to prepare guidelines (“Pass-Through Guidelines”) to promote proper talks between producers and retailers to amend existing bilateral contracts (wholesale PPAs). According to METI’s materials, the Pass-Through Guidelines will provide that: (1) each producer and retailer should properly share information about the expected increase in costs to be borne by the producer caused by the generation charge and the expected reduction in wheeling charges to be paid by the retailer and fairly discuss amending the price provided by the existing agreement; (2) particularly, the amount of the wheeling charge reductions on retailers (approximately JPY0.5/kWh) should be properly reflected in transaction prices between the producer and the retailer; and (3) in the event of any disputes in pass-through discussions between parties, parties can exert dispute resolution mechanisms for amending existing PPAs (see p. 19 of Document 4 (see here; provided only in Japanese) from the 57th Expert Panel meeting).

However, the Pass-Through Guidelines will not obligate parties to automatically shift a specific amount of the price on to retailers, and it is unclear whether the wholesale market price will rise exactly by the amount of the Average Burden after the introduction of the generation charge. It is thus still unclear how effective such guidelines will be in practice and what standards are to be applied in determining the appropriateness of revised prices.

(2) FIT Projects under a Retailer Offtake Scheme

Offtakers of FIT projects are basically electricity retailers if the PPA was executed on or prior to March 31, 2017, and TDSOs if the PPA was executed on or after April 1, 2017 (the former is hereinafter referred to as a “Retailer Offtake Scheme,” and the latter a “TDSO Offtake Scheme”).

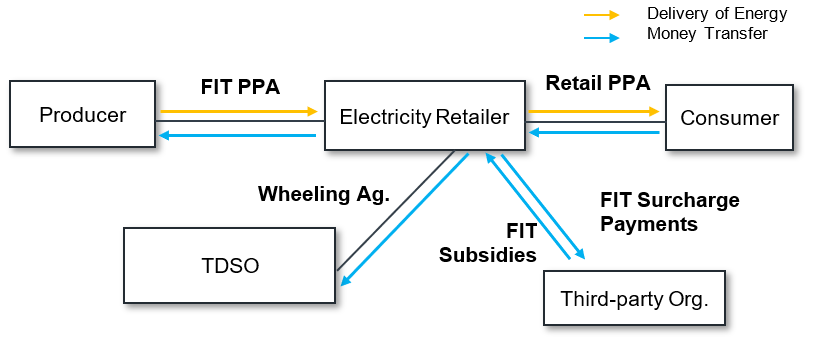

With respect to existing FIT projects under a Retailer Offtake Scheme (see below for basic contractual relationships; the offtaker of the project is a retailer), METI proposed at the 44th and 57th meetings of the Expert Panel held on December 17, 2019 and March 2, 2021, respectively, that the Pass-Through Guidelines should apply to such cases as well and that retailers should pay producers at least the amount equivalent to the Average Burden in addition to the applicable FIT price (see pp. 19 and 24 of Document 4 of the 57th Expert Panel meeting). The adjustment measures for Extra Burden are expected to be discussed further within METI and by committees established under it (see p.28 of Document 4 of the 57th Expert Panel meeting).

In addition, FIT offtakers can receive from a third-party organization a FIT subsidy (kofukin) equivalent to the amount of the FIT price paid to FIT projects after subtracting “avoidable costs” and adding and subtracting several other items, and such “avoidable costs” are principally equivalent to the wholesale price. This FIT subsidy would be reduced, however, if wholesale prices rise when the generation charge is implemented, and the funds available to retailers for pass-through would be less than the amount of the reduction of the wheeling charge. METI points out that such potential shortage of funds for pass-through needs to be addressed in discussion of adjustment measures as well (p. 24 of Document 4 of the 57th Expert Panel meeting).

The above adjustment measures could be funded through a method similar to the FIT surcharge (fukakin). Under a FIT scheme, offtakers of FIT projects receive FIT subsidies (kofukin) from the third-party organization for the part of amount of FIT price paid; such FIT subsidies are sourced from FIT surcharge payments (nofukin) that retailers pay to the third-party organization; and such FIT surcharge payments are sourced from FIT surcharges (fukakin) that are included in electricity bills paid by consumers. Although this kind of “surcharge” method could be used to secure the funds necessary for adjustment measures, it is likely to be hotly debated since it could require legal amendments to be passed by the Diet, and there are some critics strongly opposing creating another surcharge.

(3) TDSO Offtake FIT Projects

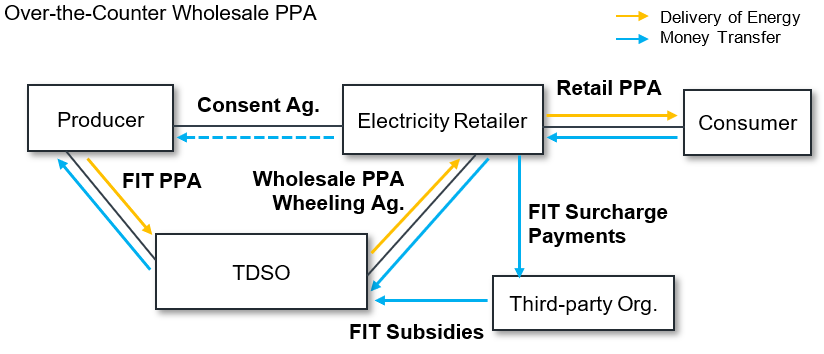

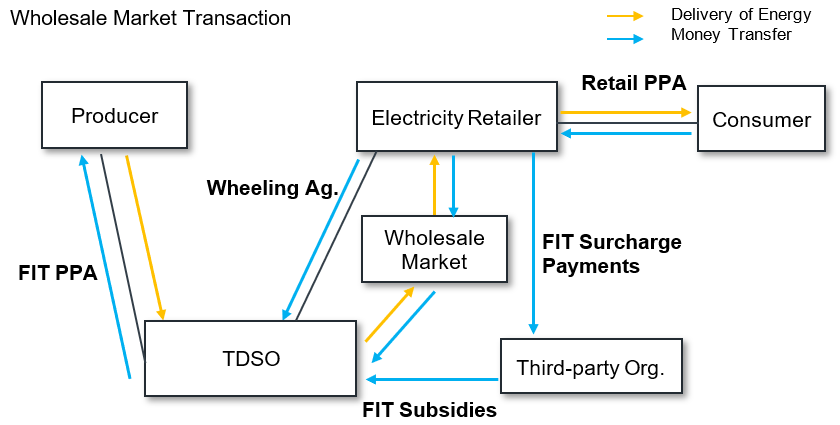

The above discussion on pass-through of the wheeling charge reduction under the Pass-Through Guidelines does not apply for a TDSO Offtake Scheme (see below for basic contractual relationships; the offtaker of the project is a TDSO and the TDSO sells such energy to retailers through over-the-counter PPAs or market transactions) since energy generated is purchased by TDSOs and not by electricity retailers. The adjustment measures for Average Burden and Extra Burden are expected to be discussed further within METI and by committees established under it (see pp. 26 and 28 of Document 4 of the 57th Expert Panel meeting).

If any adjustment measures are introduced, funds for such measures may be collected through a surcharge method, which again, would probably require passing of a new act and face criticisms as mentioned above. For the Average Burden, a possible alternative to a surcharge method would be a scheme where a TDSO makes payments to a FIT project in addition to a FIT price and the TDSO then collects such amount from the wholesale price at which it sells electricity to retailers, and thus indirectly shifts the burden from power producers to retailers.

5. Future Outlook

With respect to discussions surrounding the generation charge, there has been a big turnabout in the direction of promoting renewable energy as discussed above. The direction of the turnabout is favorable and in line with voices in the industry, but it remains unclear what measures might be taken to mitigate the impact of the generation charge on existing FIT projects, and there have been no particular discussions on measures regarding the negative impact on non-FIT VREs. Related developers, operators and investors are advised to continuously monitor the discussion and communicate the actual situation they are facing to the government.

Last year’s Minister’s Announcement in July, the carbon neutral declaration in October and the establishment of the Task Force in November all demonstrate the Japanese government’s continued efforts to promote the introduction and expansion of renewable energy, suggesting the industry is likely to continue to expand in the future. As discussions of various complex schematic reforms related to interconnection, land, environmental attributes and electricity markets run parallel while also considering criticisms related to the negative impacts of power plant development and the burdens imposed on consumers, it is ever more important for developers, operators and investors to continue to follow these matters and make their voices heard as necessary.