Insider Trading Policy Key Terms and Trends

5 minute read | June.25.2024

With the compliance deadline for the newly issued Item 408(b) of Regulation S-K approaching for calendar-year-end companies[1] and the increased use by the Department of Justice and the SEC of data analytics in pursuing insider trading cases, we analyzed the insider trading policies filed to date by early complying companies in the software and life sciences sectors. The following charts and discussion highlight the commonalities and differences among key policy terms.[2]

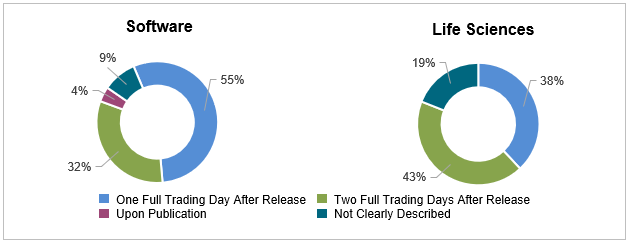

When is broadly disseminated information deemed “public”?

Insider trading policies prohibit the use of material non-public information (“MNPI”) in making decisions to purchase, sell, gift or otherwise trade the company’s securities or, in certain cases, the securities of other companies. They also prohibit providing that information to others outside of the company. For information to be considered “public,” it must be broadly disseminated, and investors must be given the opportunity and adequate time to absorb the information. Companies are largely aligned when considering broadly disseminated information to be “public” within one to two full trading days after release. So far, the data indicates that software companies tend to require one full trading day after release while life sciences companies are fairly evenly split between one or two full trading days.

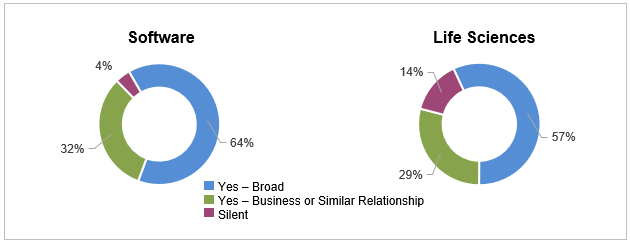

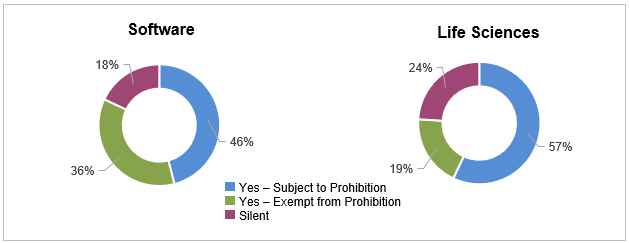

Are there restrictions against trading in the securities of another company?

Following the SEC’s recent victory in its “shadow trading” case against Matthew Panuwat, there has been heightened scrutiny on whether insider trading policies should include restrictions on trading in the securities of another company. As a result of this case, companies are increasingly intentional about the extent to which their trading prohibitions apply to securities of other companies, with some limiting application to the securities of other companies with which the issuer has a business or similar relationship.

A significant majority of companies in both the software and life sciences sectors restrict at least some trading in the securities of another company, with a minority in each sector limiting the restriction to companies with which the issuer has a business or similar relationship. Considering the data, recent case law and other developments, companies should review their insider trading policies.

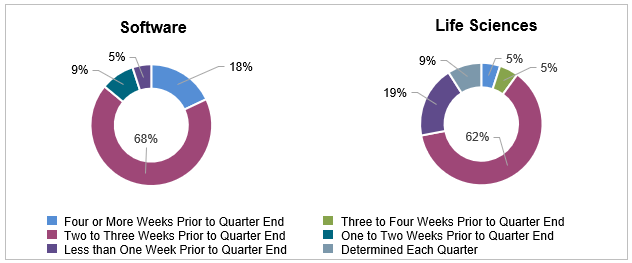

Timing of quarterly trading windows or blackout periods:

When does the quarterly backout begin?

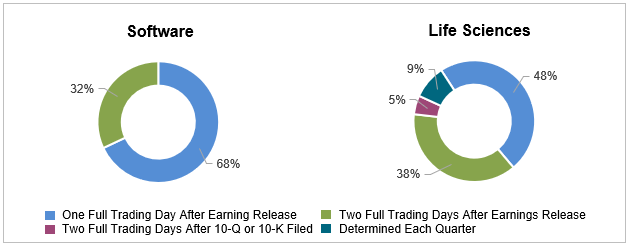

When does the quarterly blackout end?

Across sectors, most companies’ quarterly blackout periods commence between two to three weeks prior to quarter end, and end one to two full trading days after earnings release. To a lesser extent, some trading windows commence with longer or shorter than the two-to-three-week window before quarter end, roughly in line with our collective experience.

With the new compliance deadlines approaching, companies should reconsider their quarterly blackout period start and end dates, taking into account the trends and other factors such as how widely stock price-moving information is made available within the company.

Who is subjected to blackout periods and pre-clearance procedures?

Blackout periods typically apply to all Section 16 officers, and either all employees or a subset of individuals that have regular access to MNPI, with the list to be adjusted from time-to-time by compliance officers, along with certain defined family members and/or controlled entities of all such persons. The main factors companies should consider when determining who should be subject to blackout periods is how often and how widely MNPI is shared within the company. A similar analysis as to who has “access” would apply when determining which individuals are subject to pre-clearance procedures.

Unsurprisingly, there is no clear consensus on who (other than Section 16 officers and internal finance team members) is subjected to blackout periods and pre-clearance procedures. As companies grow or experience organizational changes, companies and their legal counsel should periodically review which individuals are subject to blackout periods and pre-clearance procedures.

Treatment of Gifts.

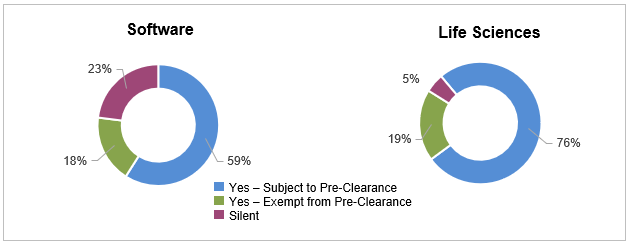

Are gifts specifically addressed in the general prohibition on transactions while in possession of MNPI?

Are gifts specifically addressed in the pre-clearance process?

A substantial majority of companies across sectors specifically cover the treatment of gifts in the provisions prohibiting transactions while in possession of MNPI,[3] and in their pre-clearance procedures. A small percentage of companies did not address gifts in either context.

While there is some modest variation, so far the data shows that insider trading policies expressly deal with gifts, and a majority of companies across sectors both prohibit gifts when in possession of MNPI and subject gifts to pre-clearance requirements, like other trades. Companies should re-evaluate their policies if they do not address the treatment of gifts.

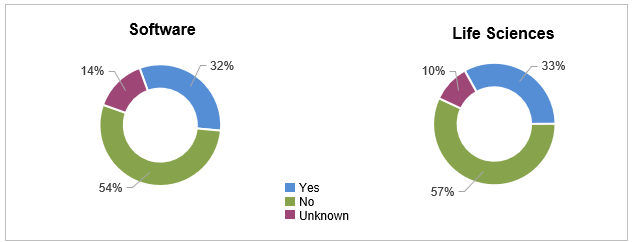

Are insider 10b5-1 plans required to include a company termination or suspension right?

A minority of companies across sectors included a company termination / suspension right over 10b5-1 plans adopted by insiders in the event of certain specified events such as underwritten public offerings or the acquisition of the company.

Notably, our data set is incomplete on this point as certain companies’ insider trading policies referenced a separate 10b5-1 plan policy that was not filed as an exhibit. Our data may improve as more companies file their insider trading policies, although it is unclear if the fairly broad language[4] used in Item 408(b) will result in companies filing documents beyond the policy itself.

Reg S-K Item 408(b)(1) disclosures

Many of the companies who filed their insider trading policies pursuant to Item 408(b)(2) of Regulation S-K did not have corresponding disclosure and/or iXBRL tagging of such disclosure in their public filings, as required by Item 408(b)(1) and (b)(3) of Regulation S-K. The requirements of the newly issued Item 408(b) are multi-pronged, and companies should include the applicable disclosure in their filings as well. Please see our model disclosures for a framework, although we encourage companies to consult with legal counsel to ensure full compliance with the new disclosure requirements.

***

To learn more about the data presented above and discuss potential revisions to your insider trading policy, please reach out to the authors (Niki Fang, Bill Hughes, Albert Vanderlaan, Soo Hwang) or other members of the Orrick team.

[1] Generally, this rule requires annual disclosure about whether a company has adopted policies and procedures prohibiting insider trading (and if not, why not). If a company has adopted insider trading policies and procedures, it must file them as Exhibit 19 to the company’s annual report on Form 10-K. Calendar-year-end companies must comply with the exhibit filing requirement starting with the upcoming annual report on Form 10-K for the year ended December 31, 2024.

[2] We reviewed each insider trading policy filed as Exhibit 19 to an annual report on Form 10-K by accelerated filers or large accelerated filers in the software and life sciences sectors—22 and 21 respectively—as of May 31, 2024.

[3] Note that several policies specifically exempting gifts from the prohibition on transactions while in possession of MNPI included a caveat that the exemption would not apply if the giver suspects the recipient may sell the securities while the giver still has MNPI.

[4] Rule 408(b) requires the filing of “insider trading policies and procedures governing the purchase, sale, and/or other dispositions of the registrant’s securities by directors, officers and employees, or the registrant itself, that are reasonably designed to promote compliance with insider trading laws, rules and regulations, and any listing standards applicable to the registrant…”.