What’s Coming in Consumer Finance Regulation & Enforcement?

1 hour watch | November.14.2024

The Trump Administration promises a new landscape for financial institutions and fintechs. Orrick’s John Coleman, Amanda Lawrence, Jeff Naimon and Katy Ryan spoke about how to plan and operate in the coming months. Discussions included:

- What can we expect from the CFPB and federal bank regulators between now and the inauguration?

- What can we learn from the Trump Administration’s first term “day one” playbook, and how might this one differ?

- What are the Administration’s likely longer-term affirmative priorities?

- What’s coming at the state level?

Key Takeaways

- The appetite for “lame duck” rulemaking will vary by agency. Agencies will balance the desire to advance final Biden administration initiatives before the inauguration with the risk of having new rulemaking rescinded through the Congressional Review Act or other mechanisms available to the incoming administration. The CFPB has the potential to be aggressive and push out several high-profile rules, including the larger participant rule for nonbank payments providers, the overdraft rule and the FCRA medical debt rule. Meanwhile, there are indications that the Fed might be more inclined to take a “wait and see” approach on Reg II and capital requirements.

- Biden-era rules won’t just go away, but informal rulemaking might. Rescinding or revising informal agency guidance – such as advisory opinions, interpretive rules, and other policy statements – can be done with the stroke of a pen. Rules that have gone through the formal notice-and-comment process are more durable. GOP control of both houses of Congress gives the Trump administration a number of ways to roll back existing regulations, but the initial focus will likely be on quickly addressing informal guidance.

- Institutions currently facing supervision or enforcement see both opportunities and risks. The incoming administration may pause or review ongoing investigations and enforcement actions. Still, existing staff recommendations will likely carry significant weight, and the motivation to resolve open matters before inauguration could provide companies with negotiating leverage at settlement. Additionally, long statutes of limitation mean past conduct may still be subject to investigation, and many states will continue their enforcement activities, so companies will benefit from an ongoing focus on compliance and consideration of state regulatory actions in their strategic planning.

- The Trump administration’s affirmative priorities are difficult to predict. The new administration is not guaranteed to fully adopt a traditional Republican deregulatory stance. A more populist approach could find Biden-era consumer protection issues like “junk fees” remaining a regulatory focus. The administration’s approach to the Federal Housing Finance Agency and the GSEs will also be an area to watch.

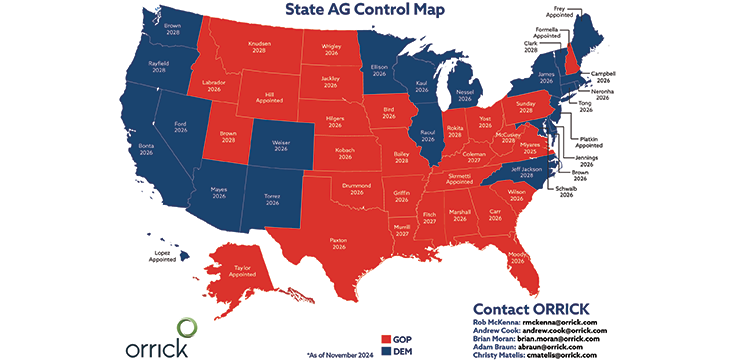

- Companies should prepare for increased state-level scrutiny, examinations, and enforcement actions. As in the first Trump administration, we anticipate states to be aggressive as they move to fill any perceived void left by federal agencies, particularly in areas like consumer protection, data privacy and bank partnerships. States have been expanding their regulatory tools and coordination and are likely to use them even more under the new administration.