Charles C. Cardall

Partner

San Francisco

Charles Cardall is a tax partner in the San Francisco office and also a member of the Public Finance Practice Group. Chas was chair of Orrick’s Tax Practice Group from 2015 to 2022. Chas primarily focuses his practice on municipal finance tax and nonprofit corporation tax matters.

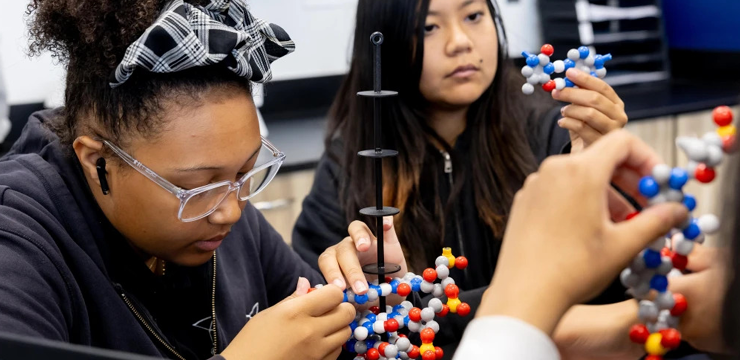

He also has legal experience relating to both charter schools and the federal income tax classification of governmental and quasi-governmental entities. He has consulted on thousands of tax-exempt, build America and tax credit bond issues and has developed deep knowledge in almost every tax aspect of municipal finance. Private activity bonds for multifamily housing, solid waste, charter schools and independent schools are areas of particular focus in his practice, as are higher education, short-term and long-term working capital and the various forms of pooled financings. Chas also has advised numerous clients experiencing financial distress or bankruptcy in tax matters relating to their municipal bonds. Representative active clients include the State of California, the University of California, the Bay Area Toll Authority, and Charter School Capital.

As a legal and policy advocate, Chas represents both government and non-government clients in federal tax rulemaking matters and in IRS proceedings, including the various types of tax-exempt bond audits, voluntary compliance (VCAP) requests and requests for private letter rulings. He has successfully closed IRS examinations relating to solid waste, water and wastewater, working capital, healthcare, pooled, multifamily housing, and industrial development bond financings. He has obtained multiple private letter rulings and technical advice memoranda and has been integrally involved in numerous regulation and legislative projects. He has found that a close working relationship with IRS and Treasury Department personnel often is critical to obtaining good results for clients.

-

Chas is a regular panelist at industry and bar association seminars on public finance tax topics (most recently on the topics of working capital financing and IRS enforcement) and has lectured to the IRS at their field agent training program.