UK Founder Series: Top Tips to Follow to Incentivise Your Team

9 minute read | August.25.2022

Orrick's UK Founder Series offers monthly top tips for UK startups on key considerations at each stage of their lifecycle, from incorporating a company through to possible exit strategies. The Series is written by members of our market-leading London Technology Companies Group (TCG), with contributions from other practice members. Our Band 1 ranked London TCG team closed over 320 growth financings and tech M&A deals totalling US$9.76bn in 2022 and has dominated the European venture capital tech market for 7 years in a row (PitchBook, FY 2022). The first instalment provided guidance to founders on the process of setting up a private limited company, and the second instalment provided guidance to founders on building their team.

Most early-stage companies are not in a position to compete with the salaries offered by large corporates to attract and retain employees. By providing an opportunity to benefit in any increase in your company’s valuation through share option grants, options can play a crucial role in offering attractive compensation packages and aligning the interests of employees and shareholders. This article provides an overview of share options and the key issues you should consider when using them to recruit, retain and incentivise your team.

The difference between shares and options

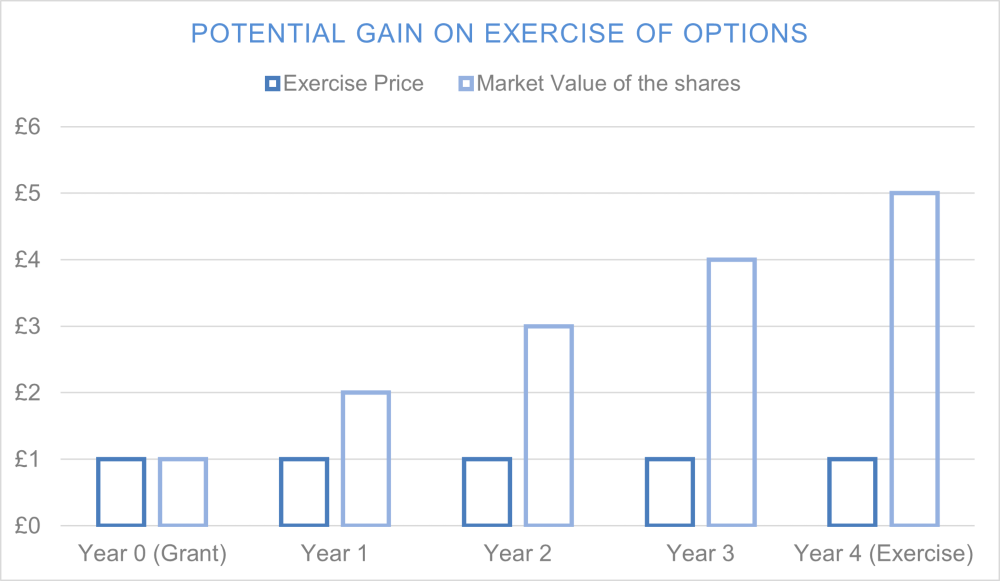

1. Shares or options. A share option is a contractual right (not an obligation) to purchase a company’s shares, subject to certain conditions and at a pre-determined price (known as the “exercise price” or “strike price”). Unlike the issue and allotment of shares, upon the grant of an option, an optionholder does not become a shareholder in the company. The optionholder only becomes a shareholder if they choose to exercise their options. Given that the optionholder is only allowed to exercise their option in certain circumstances and is not obliged to purchase the underlying shares, share options are a very flexible incentive. Where shares are issued to an employee, they suffer an up-front tax charge, whereas an option is not taxed at the time of grant — the tax charge crystallises in the future.

2. Consider who you should be granting options to. Options are generally granted to employees and executive directors but can also be granted to non-executive directors, consultants, advisors, employers of record employees, and third parties contracting via personal service companies (subject to relevant local laws and the type of share option scheme chosen (see more below)). In the UK it is increasingly common to grant options to all employees of venture-backed businesses, not just executives. Think carefully about who will be able to benefit from your share option scheme, for example, you should avoid granting options to ex-employees to make the most of the scheme. Your scheme should also be fair, and the grants awarded according to objective and transparent criteria.

Key types of share option schemes

There are two typical categories of share option schemes: tax advantaged and non-tax advantaged.

3. Enterprise Management Incentive (“EMI”) options. EMI options are a tax-efficient and flexible way to grant options, provided certain detailed requirements are met as to: (a) the company granting the options; (b) the employees being granted the options; (c) the terms of the options; and (d) the shares under option. Eligible employees may be granted EMI options up to the value of £250,000. Your company or group must (among other requirements): (a) be independent; (b) carry on a “qualifying trade”; (c) not have gross assets exceeding £30 million (the “gross assets test”); and (d) have fewer than 250 full-time equivalent employees. We frequently see later stage startups breaching the gross assets test post-funding rounds due to investment monies being reflected on their balance sheets – keep an eye on this as you grow. HMRC must also be notified of EMI option grants within 92 days (and evidence of this retained by the company) and an EMI Annual Return submitted yearly.

4. Company share option plans (“CSOP”). CSOPs are a tax advantaged share option plan which you might use if your company does not meet the EMI requirements. We commonly see startups at later stages making use of CSOPs. Eligible employees may hold up to £30,000 of unexercised CSOP options (to be increased to £60,000 from April 2023). However, as with EMI options, certain conditions need to be met. For example, your company must be independent, and options must be granted over a certain type of share, though it is expected that pursuant to the release of the Government’s “mini-budget” on 23 September 2022, these requirements will be relaxed in the near future. We will be updating this article with any relevant changes, so watch this space.

5. Non-tax advantaged share option schemes. These types of option plans are much more flexible than CSOPs or EMI, allowing you to grant non-tax favoured share options where your company is unable to satisfy the requirements for CSOP or EMI. These plans are potentially easier to implement and operate than tax advantaged schemes but do not provide the same generous taxation benefits. We frequently see startups use non-tax advantaged options for their non-executives, advisors and consultants, as EMI and CSOP options can only be granted to employees.

Key considerations

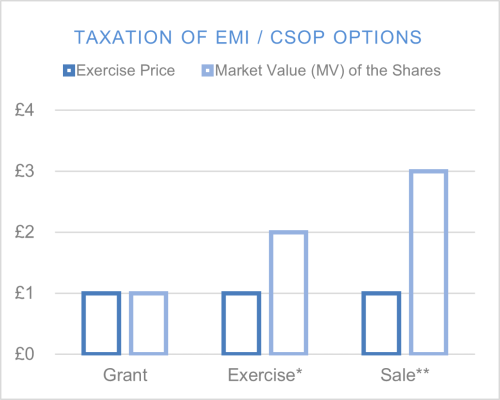

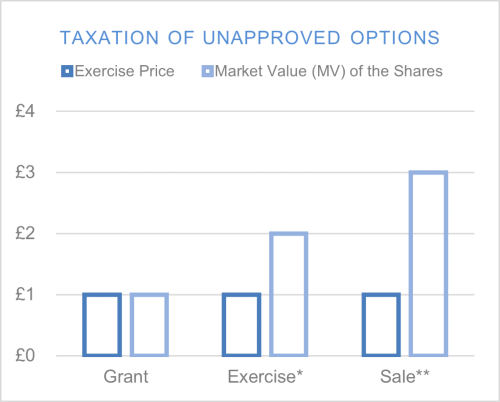

6. Consider the tax implications. Firstly (if all requirements continue to be met), employees are taxed on EMI and CSOP options at the point of sale of the shares received on exercise of the option. This is in contrast to employees who have been granted unapproved options who are taxed at the point of exercise of the option and at the point of sale of the shares. Secondly, optionholders selling shares acquired on the exercise of EMI and CSOP options are subject to capital gains tax (currently taxed at a rate of 20% on shares) on any gain made on the shares, whereas optionholders holding unapproved options are subject to income tax and national insurance contributions (“NICs”) on any difference between the exercise price and the value of the shares, and capital gains tax on any gain made on the shares. Given the company’s potential PAYE obligations to account to HMRC for any income tax and NICs, appropriate indemnities should be included in your share option scheme.

** Capital gains tax due on difference between MV and Exercise Price on Sale (here, £2).

** Capital gains tax due on additional gain on Sale (here, £1).

7. Include a vesting schedule. A vesting schedule provides that an optionholder “earns” options over an increasing number of shares: (a) at set times (“time-based vesting”); or (b) on the satisfaction of certain performance conditions (“performance-based vesting”). The greater the number of options that are vested, the greater the number of shares the employee would be entitled to if the employee was able to exercise the option and receive shares (if the option was “exercisable”). The vesting schedule assists with employee retention as it rewards option holders to remain with a company. Without a vesting schedule, an optionholder would be entitled to all their options at the point of grant. It is market standard in the UK and US for venture-backed startups to apply time-based vesting over a four-year period, where no options vest during the first year (known as the “cliff”), and thereafter “linear” vesting monthly over the next three years. However, we have also seen the rise of back-loaded vesting. Even though an option is vested, it also needs to be exercisable before the employee can exercise the option and receive shares in a company. Whilst it is common for share option schemes to provide for options to be exercisable as they vest, some share option schemes provide for options to be exercisable only on an “exit event” (typically defined as an IPO, a sale, or a liquidation event such as a funding round or secondary sale), known as an “exit-only” share plan.

8. Consider what happens if the optionholder leaves. Leaver provisions govern what happens with an optionholder’s options when they leave a company, in particular through (a) good and bad leaver definitions; and (b) how vested and unvested options are treated for each type of leaver. UK market practice is leaning towards a good leaver being anyone who leaves other than for “cause” (i.e. gross misconduct, fraud), which follows the US market position. A bad leaver’s unvested and vested options will generally lapse (i.e. the right to purchase shares is extinguished). Good leavers are typically allowed to exercise their vested options within a certain time period (usually 90 days), with their unvested options lapsing.

9. What happens on a change of control. On a change of control, such as the sale of a company, optionholders might be permitted to exercise their vested options immediately prior to the transaction (so that the shares may be sold to the potential purchaser) or, (depending on the transaction structure) swap their options in the target company for options in the acquiring company (known as an option rollover). Companies may also “accelerate” vesting in connection with a change of control, so that an optionholder’s previously unvested options will vest and become exercisable. We will explore exit readiness later on in the Series.

Key points in setting up your share option scheme

10. Documentation. A share plan sets out the overarching terms and conditions pursuant to which share options are granted. An option agreement is then entered into for each grant and records the number of shares subject to the option and the exercise price. This set up allows for the terms of option grants to be personalised. Where EMI or CSOP options are being granted, startups should also obtain a valuation for the shares which will be under option, which can be agreed with HMRC. If you are in the process of hiring your early employees but have not yet set up your option scheme and wish to give early employees an indication of the proposed grant pre-contract, this may be possible through an option intention letter, which should refer to the number of shares they will be granted an option over and not to values or percentages of the share capital of the company.

Our London Compensation & Benefits team are here to advise you on the topics raised above and provide other general UK incentives law advice. The team regularly advise early-stage companies on all aspects of compensation and benefits, from guidance on setting up your option scheme, to managing your optionholders on an exit.

If you would like more details on any of the issues above, please contact Jamie Moore (jamie.moore@orrick.com).