The Download: A Conversation with Evercore on the Market Outlook

6 minute read | March.12.2024

WHAT WE'RE SEEING

01 A conversation with Evercore on the market outlook

02 Will there be an alternative path to public?

03 What’s ahead for tech and life sciences IPOs?

04 The Download Quiz: Venture Capital Trends

/ 01

A CONVERSATION WITH EVERCORE

2024 Capital Markets Outlook: From the election year, AI and regulation … to the tech IPO playbook

The 2024 election cycle and continuing geopolitical risks are likely to bring even greater volatility to the capital markets this year – there’s consensus on that.

Due to the election cycle, tech companies looking to go public are targeting a shorter IPO window, with an overwhelming preference to get out before July, Evercore’s John Scuorzo and Zaheed Kajani tell Orrick’s Jamie Evans. Two or three successful tech IPOs may spur a second wave of fast followers, though overall, the hopeful expectation is that tech IPO activity in 2024 will reach about half of the historical average of about 40 IPOs raising $20 billion.

Drawing on insights from last year’s few tech IPOs, cornerstone investors will likely play a more moderate role in offerings (10-15% of total deal size) and there will be a return to deal sizes of about 10-15% of market cap to attract large public investors who value liquidity long term. The proliferation of novel structures such as SPACs may pause, but Kajani and Scuorzo expect the traditional IPO playbook to continue to evolve. For instance, there continues to be interest in innovating to provide more liquidity options to investors, and sooner.

Regulation will also play into the way in which tech companies access the capital markets, Evans says. There is tremendous focus on emerging technologies like AI and significant and high-profile enterprise risks like cybersecurity, which is likely to increase scrutiny on disclosure and transaction diligence. Furthermore, the SEC’s recent rule-making efforts related to SPACs is consistent with the more active regulatory posture seen during the Biden administration, and there will be knock-on effects that impact other, more traditional parts of the capital markets.

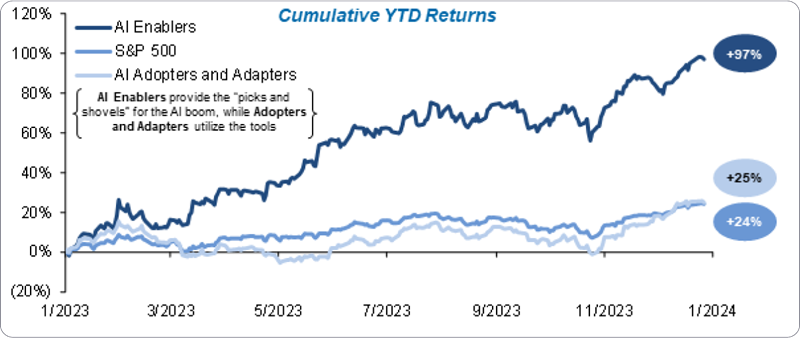

Public AI “Enablers” Outperformed in 2023

Source: Bloomberg, Evercore ISI

AI Enablers: Equal Weighted Returns of AMZN, GOOGL, INTC, LRXC, META, MSFT, NVDA

AI Adopters and Adapters: Equal Weighted Returns of ADBE, AES, ARE, BKNG, BXP, CDAY, CLH, DUOL, DPZ, EMR, ETN, ETSY, EXPE, GDDY, JPM, PINS, PSTG, TMUS, VEEV, WDC, ZS

Companies enabling the deployment of AI – such as semiconductor and software companies – are seeing returns today and will be the first to experience the success or failure of those investments, Scuorzo says. 2024 will be the year of adopters and adapters as management and boards turn to deploying genAI and other hyperproductivity tools to grow their business, streamline costs and future-proof against competitors.

Will there be an alternative path to public?

The SEC is on pace to propose 63 new rules by the end of Chair Gary Gensler’s first four years in office, based on a review of the SEC’s spring 2023 rule list. This significant agenda compares with the 22 rules and 43 rules during the entire terms of the two prior SEC chairs. The SEC’s agenda is broad, covering emerging areas such as climate-related disclosures and SPACs, and revisiting core areas, including the definition of dealers, exchanges and alternative trading systems, beneficial ownership report timing, insider trading, cybersecurity disclosure and repurchase plans (which was ultimately stalled by the Fifth Circuit).

But one clear focus of the SEC staff is encouraging more traditional IPOs and creating equivalent liability and disclosure regimes for alternative paths to public like de-SPAC transactions or reverse mergers. We’re seeing more aggressive review of the disclosures of public companies engaging in reverse mergers to assess whether the preclosing public company was a shell company prior to engaging in the reverse merger. The SEC’s conclusion that more of these companies are shells aligns with its recent final rules on de-SPACs, and it’s causing more issuers to question whether any going-public transaction other than an IPO is feasible from a regulatory risk or expense perspective.

So, is a return to the traditional IPO path the only route when the market returns? Much like the deregulation efforts during the initial Trump administration, any change in leadership could change the SEC’s posture dramatically. In the meantime, issuers and their advisors and capital markets participants generally are watching developments closely.

What’s ahead for tech and life sciences IPOs?

Tech and life sciences companies are expected to make up as much as two-thirds of the IPO pipeline when it reopens, but elevated volatility remains high. Market recovery from the historic two-year low hinges on several factors, from macroeconomic conditions to regulation to the election cycle – that was the clear consensus at Northwestern University Pritzker School of Law’s 51st Annual Securities Regulation Institute conference last month.

No doubt, the timely realization of anticipated interest rate cuts, sustained recovery of stock prices across relevant sectors, and continuing broad-based economic growth will play important roles in the recovery of the IPO market – and issuers will need to show strong performance, including at the least a path to meaningful profitability.

With election headwinds and continued geopolitical uncertainty looming, companies will aim to get deals done in the first half of the year. Some experts believe Q3 and Q4 may be busier than some industry participants expect, provided there is a sustained recovery (e.g., new issue stock prices do not fail to perform in the aftermarket).

Other themes include:

- Investor Appetite: IPO investors are looking for sustainable and profitable growth, and valuation expectations should be tempered, particularly in light of so many of the companies that went public in 2021 are now trading below issue price. Anchor investors will continue to play a large role as they did in Q3 of last year.

- Alternatives: Non-traditional public listing transactions will continue but at a lesser pace. Direct listings, de-SPACs and reverse mergers may remain an option for certain companies, depending on their profile, but on the whole, traditional IPOs are expected to continue to be the primary means of completing a public listing, particularly given the regulatory overhang. Some changes are likely given the evolution of other paths to public over the past several years (including, for example, more modifications to the traditional lock-up regime for pre-IPO investors seeking earlier liquidity).

- Cyber: In particular, incident disclosure and disclosure controls and related procedures will be a focus for all market participants – from the SEC and media to issuers and boards to investors.

- Climate: Some expressed concerns that the SEC’s new rules requiring disclosures in registration statements may have a chilling effect on transactions. No doubt, navigating disparate regimes and complying with a growing number of state regulations will remain on the minds of issuers. As Orrick’s J.T. Ho noted in his presentation, “Tackling Your ESG Disclosures in an Evolving World,” companies should ignore all the noise around ESG and focus on implementing human capital and sustainability initiatives that will contribute to long-term value.